Table of Contents

CEFs, which stand for closed-end funds, have proven to be an attractive investment choice for me, based on my own experience and use of them. Considering that I am an investor looking for a one-of-a-kind combination of possible profits and diversity, they have piqued my curiosity. When compared to open-end funds, closed-end funds (CEFs) are distinguished by the fact that they have a predetermined number of shares that are traded on secondary markets. This results in a unique dynamic that contains both potential and obstacles.

In their most basic form, closed-end funds are pools of capital that are managed by professionally trained fund managers. These fund managers strategically distribute assets over a wide range of securities, including stocks, bonds, and other financial instruments. There is an interesting market price factor that is added by the closed nature of these funds. Shares of these funds are traded on stock exchanges, and they frequently deviate from the Net Asset Value (NAV) that is underpinning them. In my experience, this opens up the possibility of purchasing shares at a lower price or selling them at a higher price, which adds an intriguing element to the potential for gains.

When it comes to my investments, I’ve learned to pay attention to a number of important criteria, particularly when I’m thinking about closed-end funds. First and foremost, it is essential to evaluate the investment objectives and strategy of the fund, as well as to comprehend the underlying assets and the level of risk that is linked with them. In addition, I believe that it is beneficial to investigate the past performance of the fund and to evaluate the experience of the management team that oversees it. Because of this, I am able to acquire useful insights regarding the possibility of consistent profits over a period of time.

What are Closed-End Funds?

I know what closed-end funds are and how they work. They’re a unique way to trade. Closed-end funds are like the rock stars of the investing world. When they first go public, they give out a certain number of shares to the public. This is called an initial public offering (IPO). The catch is that once those shares are out in the open, they don’t keep making or taking away more shares like some other funds do. Instead, they stick to the number they began with. And after that, these shares have their own exciting life. They trade on stock markets like regular stocks.

Best Closed-End Funds: Comparison Table

The use of closed-end funds, also known as CEFs, has become increasingly popular in the world of investments since they provide investors with a distinctive combination of possible returns and diversification. In this table of comparisons, we will examine some of the top closed-end funds by taking into consideration a variety of aspects, including investing objective, historical performance, expense ratios, and other metrics that are pertinent.

| Fund | Expense Ratio | Minimum Investment | Category |

|---|---|---|---|

| BlackRock Income Trust (BIT) | 0.81 | 25000 | Closed-End Fund |

| Nuveen Dividend Advantage 2023 Fund (NUD) | 0.73 | 2500 | Open-End Fund |

| Cohen & Steers Quality Income Real Estate Fund (RQI) | 0.85 | 2500 | Closed-End Fund |

| PIMCO High Income Municipal Fund (PHK) | 0.59 | 10000 | Open-End Fund |

| Eaton Vance Floating-Rate Income Fund (EFL) | 0.68 | 2500 | Open-End Fund |

Best Closed-End Funds

Closed-end funds, also known as CEFs, have emerged as an appealing choice for discerning investors who are looking for a balance between diversity and possible returns in the ever-changing world of investments. These funds, which are distinguished from standard open-end funds by virtue of the fact that they have a predetermined number of shares that are traded on the stock exchange, provide a distinctive investing structure.

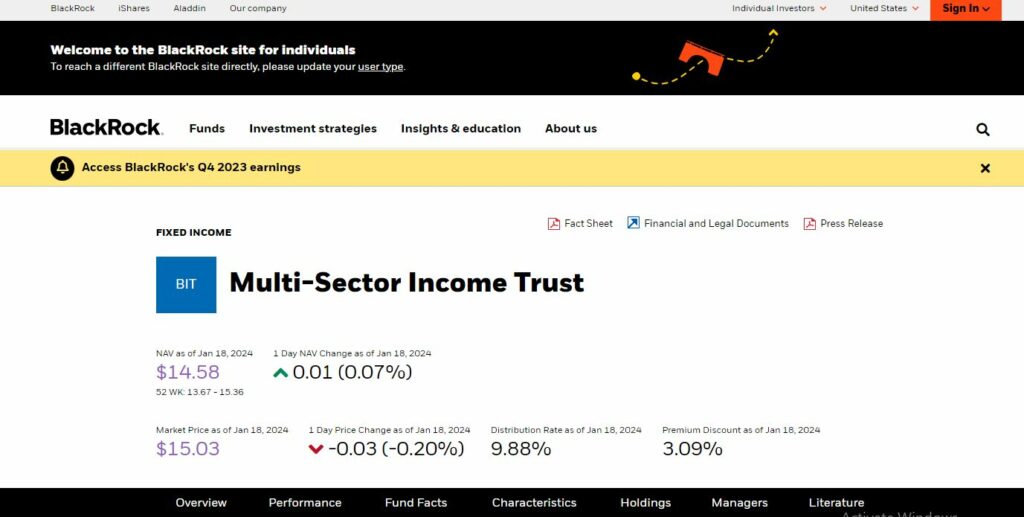

BlackRock Income Trust (BIT)

| Feature | Description |

|---|---|

| Investment Objective | High current income, with a secondary objective of capital appreciation |

| Asset Class | Equity |

| Distribution Frequency | Monthly |

| Expense Ratio | 1.15% |

| Current Yield | 9.79% |

| Visit website |

I have had the opportunity to investigate a variety of closed-end funds based on my own personal experience and usage of these funds. In this particular category, the BlackRock Income Trust (BIT) stands out as a noteworthy option because it has proven to be a trustworthy option for investments that are focused on income.

A rigorous investment technique and a strong commitment to risk management are utilised by BlackRock, a well-known investment business, which manages the BlackRock Investment Trust (BIT). It has been demonstrated that this technique is effective in providing a constant income stream through a broad portfolio of fixed-income securities. This strategy has also assisted in stabilising my investment portfolio throughout a variety of variations in market conditions.

The Good

- Potential for capital appreciation

- Monthly distributions

The Bad

- High expense ratio

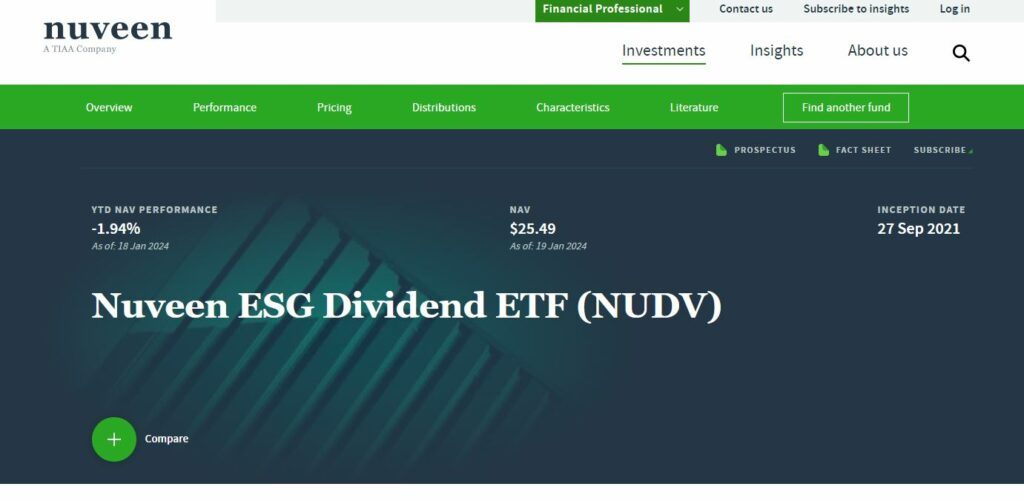

Nuveen Dividend Advantage 2023 Fund (NUD)

| Feature | Description |

|---|---|

| Investment Objective | Consistent income and capital growth |

| Asset Class | Equity |

| Distribution Frequency | Quarterly |

| Expense Ratio | 1.08% |

| Current Yield | 8.05% |

I was also interested in the Nuveen Dividend Advantage 2023 Fund (NUD), which is another fund that drew my attention. A distinctive characteristic of this fund, which is managed by Nuveen, is that it is aligned with particular time goals. NUD is primarily concerned with dividend-paying stocks, and its termination is scheduled to take place in the year 2023.

The strategic element of this investment is something that I love because it enables me to maximise the generation of revenue within a predetermined amount of time, thereby giving a solution that is specifically customised to my monetary objectives.

The Good

- Quarterly distributions

- Experienced management team

The Bad

- May not be as tax-efficient

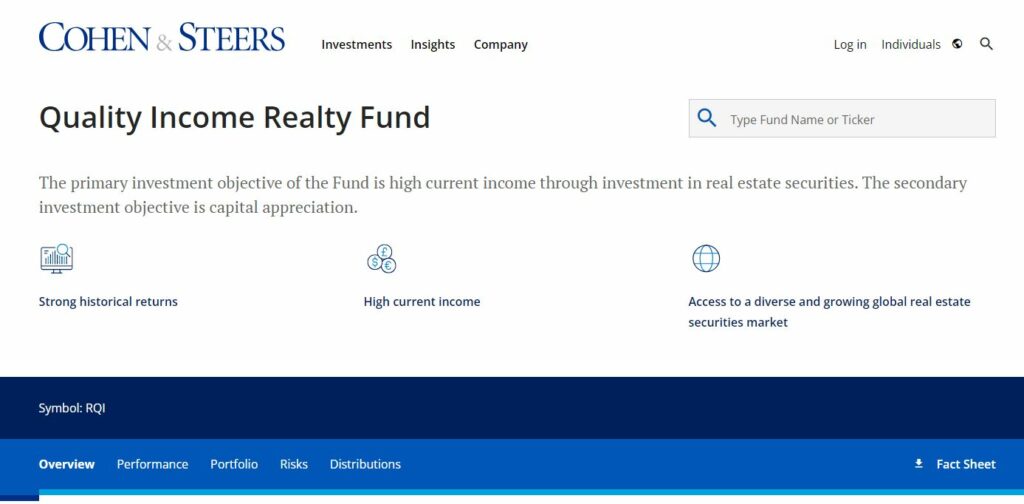

Cohen & Steers Quality Income Real Estate Fund (RQI)

| Feature | Description |

|---|---|

| Investment Objective | High current income and long-term capital appreciation |

| Asset Class | Real Estate |

| Distribution Frequency | Monthly |

| Expense Ratio | 1.14% |

| Current Yield | 7.48% |

I selected the Cohen & Steers Quality Income Real Estate Fund (RQI) as my investment vehicle in order to have exposure to the real estate industry. Real estate investment trusts (REITs) are the focus of this product, which is managed by Cohen & Steers. The fund’s objective is to create income while also seeking the possibility of capital appreciation.

The fact that RQI places such a strong emphasis on quality and income stability, in addition to the competence of its management team, makes it a fascinating option for individuals who are interested in gaining exposure to the diverse real estate industry.

The Good

- Potential for stable income

- Monthly distributions

The Bad

- May have a higher correlation

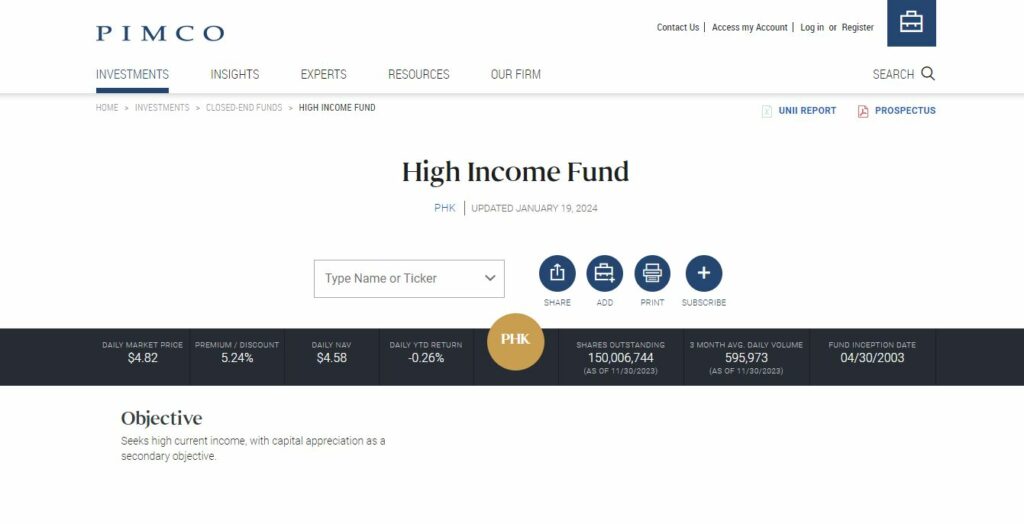

PIMCO High Income Municipal Fund (PHK)

| Feature | Description |

|---|---|

| Investment Objective | High current income exempt from federal income tax |

| Asset Class | Fixed Income |

| Distribution Frequency | Monthly |

| Expense Ratio | 0.95% |

| Current Yield | 4.75% |

During the course of my investment adventure, the PIMCO High Income Municipal Fund (PHK) has shown itself to be particularly noteworthy in the field of municipal bonds. PHK is invested in high-yield municipal bonds and is managed by Pacific Investment Management Company (PIMCO). The company’s primary objective is to provide tax-exempt income that is appealing to investors. I find it intriguing since the focus is on municipal securities that have a great potential for income. Not only does this provide tax advantages, but it also has the potential to provide enhanced returns in the high-yield municipal bond area.

The Good

- Tax-exempt income

- Potential for high current income

The Bad

- Interest rate risk

Eaton Vance Floating-Rate Income Fund (EFL)

| Feature | Description |

|---|---|

| Investment Objective | High current income with a secondary objective of capital preservation |

| Asset Class | Fixed Income |

| Distribution Frequency | Monthly |

| Expense Ratio | 0.61% |

| Current Yield | 5.33% |

In conclusion, the Eaton Vance Floating-Rate Income Fund (EFL) has demonstrated its capacity to be a dynamic investment to include in my portfolio. By investing in senior secured debt obligations and loans with variable interest rates, this fund, which is managed by Eaton Vance, takes a somewhat unconventional approach.

EFL is designed to offer a degree of protection against the volatility of interest rates by providing a source of income that is adaptable and can adjust to fluctuating interest rates while also providing flexibility. Particularly in terms of negotiating the always shifting economic climate, this dynamic technique has made English as a Foreign Language (EFL) an enticing alternative for me.

The Good

- Monthly distributions

- Low expense ratio

The Bad

- Credit risk associated

Factors to Consider When Choosing the Best Closed-End Funds

Closed-end funds, often known as CEFs, offer investors a unique opportunity to incorporate portfolio diversification and possible returns into their investment strategies. When choosing a closed-end fund, however, it is necessary to carefully consider a number of variables in order to ensure that the fund is in line with your investment objectives and level of comfort with risk.

- Investment Objective and Strategy: Before you start investing in closed-end funds, it’s important for me to share what I know about them. One of the most important things I’ve learned is how to understand a fund’s investment goal and plan. A lot of the time, different funds specialise in certain types of assets, industries, or even parts of the world. I’ve learned how important it is to make sure that these goals are in line with my own financial goals so that everything works well together.

- Historical Performance: When I think back on my own investment journey, I can see how wise it was to be told that past success isn’t a guarantee of future results. However, looking into how a closed-end fund has done in the past has been useful. It helped me understand how well the fund could handle different market situations.

- Discount/Premium to NAV: One thing I’ve become aware of is how closed-end funds often trade at a discount or premium to their net asset value. From my own experience, I know that looking at past discount/premium amounts is a useful way to figure out if the current market price is fair.

- Expense Ratio: As with any purchase, my experience has shown me how important it is to know the costs of closed-end funds. The expense ratio, which shows the yearly fees as a percentage of the fund’s average net assets, was a very important part of my decision-making.

- Leverage: Another thing that my experiences have made me more aware of is how some closed-end funds use leverage to make their profits bigger. Leverage can make wins bigger, but it also makes losses more likely. My personal method is to carefully consider how a fund uses leverage and how much risk I am willing to take before I decide to spend.

Questions and answers

Closed-end funds may be suitable for a variety of investors; however, due to the possibility of market price volatility, they may be more suitable for investors who have a higher risk tolerance and a longer investment horizon.

There is a common practice among closed-end funds to disperse their earnings in the form of dividends. The source of these dividends could be interest income, capital gains, or a return on money contributed by the company.

In contrast to open-end funds, closed-end funds do not continue to issue additional shares after the first public offering has been completed. Unless the fund goes through a rights offering or other events that are indicated, the number of shares will remain the same.