Table of Contents

Mobile buying on smartphones has become much more common in recent years, which has completely changed the way trading is done. It’s now very easy to trade on both iPhones and Android devices, no matter how experienced you are or how new you are to dealing. Going on a trading trip with your smartphone is no longer just a convenient choice; it has become a complete and smooth experience. Not only do these platforms offer commission-free stock trading, but they also have fully-featured, easy-to-use online trading tools that make them appealing. Keeping up with the latest market trends is very important for investors because it helps them be ready for both potential problems and profitable chances, which lets them make smart choices.

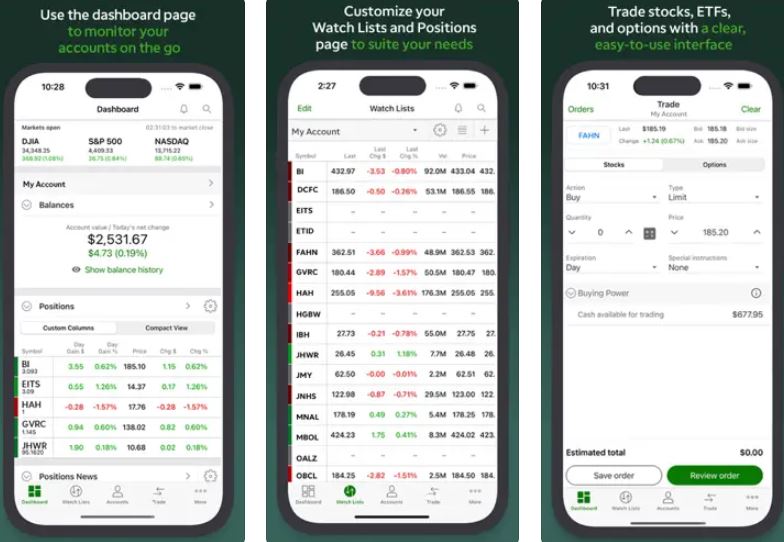

Most reputable online brokerage firms have accepted the age of smartphones by giving their customers mobile apps. They do this because they know how important it is for investors to stay in touch with the ever-changing market. The days when you could only make simple trades and look at web portfolios are long gone. These days, trading apps for smartphones offer more than just usefulness; they offer a complete, all-around experience.

These state-of-the-art apps do more than the basics; they have a huge range of features, from simple trading tools to the ability to handle complicated options without any problems. In addition, they give users access to detailed charts and more complicated order types, which turns the smartphone into a high-tech tool for navigating the complex financial markets. As the era of simple trades comes to an end, the best trading stocks apps for smartphones usher in a new era where buyers can trade in a world that is both immersive and full of options.

Best Stock Trading apps for iPhone

A stock market investment app is your entrance to your money and assets, whether you are on the go, sitting on the couch, or watching a TV in bed at the end of a hard day. It allows you to access your money and investments from anywhere. In order to locate the greatest stock market app for your iPhone or iPad, it is likely that you will find it helpful to select an investing account that offers the appropriate combination of features and fees for your requirements.

| Commissions | Account Minimums | Trading Platform | Investment Offerings | Research & Education | Margin Accounts | Customer Service | |

|---|---|---|---|---|---|---|---|

| TD Ameritrade | $0 stock & ETF trades, options fees | None | thinkorswim (powerful, desktop & mobile), web platform | Stocks, ETFs, options, mutual funds, futures, forex | Extensive research tools, educational resources | Yes | 24/7 phone & live chat |

| Robinhood | $0 stock & ETF trades | None | Simple, mobile-first | Stocks, ETFs, options | Limited research, basic educational articles | Yes | Phone & email support |

| Charles Schwab | $0 stock & ETF trades | None | StreetSmart Edge (robust, desktop & mobile), web platform | Stocks, ETFs, options, mutual funds, futures, forex, bonds | Comprehensive research reports, investor education courses | Yes | 24/7 phone & live chat |

| Webull | $0 stock & ETF trades | None | User-friendly, mobile-first | Stocks, ETFs, options | Fundamental & technical analysis tools, educational videos | Yes | 24/7 phone & live chat |

| TrendSpider | N/A (charting platform) | None | N/A (charting platform) | N/A (charting platform) | Advanced charting tools, market analysis reports | N/A | Email & ticketing system |

Best Stock Trading apps for iPhone

You become the owner of a small portion of a publicly traded corporation when you purchase shares of stock. Shareholders are granted the right to vote on corporate decisions, receive dividend payments, and benefit from the growth of the firm. In addition, shareholders are eligible to receive dividend payments. On a stock exchange, shares of stock are traded with one another. The financial success of a firm, the supply and demand on the stock market, and the performance of the economy as a whole all have a role in determining the price of a stock.

TD Ameritrade

| Feature | Description |

|---|---|

| Advanced Trading Tools | Access to powerful trading platforms and tools. |

| Research and Education | Extensive resources for market research and education. |

| User-Friendly Interface | Intuitive platform design for easy navigation. |

| Mobile Trading | Trade on the go with a user-friendly mobile app. |

| Investor Community | Connect with other investors for insights and discussions. |

| App Store |

Based on my own personal experience, I can confidently say that TD Ameritrade is a seasoned veteran operator in the financial industry. The purpose of this platform is not only to provide access to trade; rather, it is an all-encompassing hub that is embellished with a multitude of research tools and instructional resources. The temptation of commission-free trading for stocks, exchange-traded funds (ETFs), and options is a boon for active traders. It provides a handy one-stop solution that caters to the different needs of experienced investors.

The Good

- Robust trading tools for active traders.

- Comprehensive research and educational resources.

- User-friendly interface for easy navigation.

- Mobile app for convenient on-the-go trading.

- Engaging investor community.

The Bad

- Higher fees compared to some competitors.

- Complex platform may be overwhelming for beginners.

Robinhood

| Feature | Description |

|---|---|

| Commission-Free Trading | Trade stocks, options, and ETFs without commission fees. |

| Fractional Shares | Invest in fractional shares of stocks with small amounts. |

| Simple Interface | Easy-to-use platform with a minimalist design. |

| Cryptocurrency Trading | Access to cryptocurrency trading within the same app. |

| Real-Time Market Data | Stay updated with real-time market quotes and data. |

In light of my own personal experience with the world of investing, I can confidently say that Robinhood is a genuine advocate for the democratization of the investment sector. An approachable entry point into the market is provided by the user-friendly interface, which attracts novices. Trading fractional shares is a game-changer for those who are just starting out because it enables them to test the waters without completely emptying their bank accounts. While it is true that commission-free trades are appealing since they help keep costs under control, it is important to note that the research tools offered by the platform may be rather restricted.

The Good

- Commission-free trading for stocks, options, and ETFs.

- Fractional share investing for small budgets.

- User-friendly and minimalist interface.

- In-app cryptocurrency trading.

- Real-time market data.

The Bad

- Limited research and analysis tools.

- Customer service can be slow to respond.

Charles Schwab

| Feature | Description |

|---|---|

| Low-Cost Trading | Competitive pricing for stock, options, and ETF trades. |

| Robo-Advisory Services | Automated investment management with Schwab Intelligent Portfolios. |

| Extensive Research | Access to a wide range of research and market insights. |

| Educational Resources | Comprehensive educational resources for investors. |

| Customer Service | 24/7 customer support for assistance. |

When I think back on my experiences, I realise that Charles Schwab is a reliable organisation that provides a portfolio of financial products that have been tested over the course of time. Their portfolio includes equities, bonds, mutual funds, and individual retirement accounts (IRAs), making it possible for them to meet the varied requirements of investors of all experience levels. In addition to providing an additional layer of assistance to individuals who are navigating the complexity of the market, Schwab’s personalised service is what sets them apart from their competitors.

The Good

- Low-cost trading fees.

- Robo-advisory services for automated investing.

- Extensive research and market insights.

- Comprehensive educational resources.

- 24/7 customer service.

The Bad

- Higher fees for some mutual funds.

- Platform interface can be overwhelming for beginners.

Webull

| Feature | Description |

|---|---|

| Commission-Free Trading | Trade stocks, options, and ETFs without commission fees. |

| Advanced Charting Tools | Powerful charting tools for technical analysis. |

| Extended Trading Hours | Access to extended market hours for trading. |

| Paper Trading | Practice trading with virtual money using the paper trading feature. |

| Real-Time Market Data | Stay updated with real-time market quotes and data. |

I began my trip by delving into the world of tech-savvy trading, and it was during this quest that I came across Webull, a platform that is appealing to individuals who value complex charting tools and social features. The allure of commission-free trades and margin accounts is powerful enough to attract active investors who are looking to maximise the effectiveness of their methods. For individuals who are just beginning their journey into the exciting world of investing, Webull provides a comprehensive set of educational resources, which is an impressive demonstration of the company’s commitment to empowering novice investors.

The Good

- Commission-free trading.

- Advanced charting tools for technical analysis.

- Extended trading hours for flexibility.

- Paper trading feature for practice.

- Real-time market data.

The Bad

- Limited research and educational resources.

- Customer service response time may vary.

TrendSpider

| Feature | Description |

|---|---|

| Automated Technical Analysis | Utilizes algorithms for automated chart analysis. |

| Dynamic Alerts | Set dynamic alerts based on technical indicators. |

| Backtesting | Test trading strategies with historical data. |

| Multi-Timeframe Analysis | Analyze charts across multiple timeframes simultaneously. |

| Cloud-Based Platform | Access your analysis and charts from anywhere with cloud storage. |

For someone like me, who is a firm believer in technical analysis, TrendSpider has been a revelation in my journey through the world of investing. Rather than focusing solely on charts, this platform is designed to equip technical analysts with powerful charting and back testing tools. Tasks such as spotting patterns, testing trading techniques, and visualising market movements and trends in the market become smooth. TrendSpider is a true game-changer for individuals who are fully entrenched in the area of technical analysis. It provides the tools that are necessary to negotiate the complexities of the market with confidence.

The Good

- Automated technical analysis for efficient charting.

- Dynamic alerts for timely notifications.

- Backtesting to evaluate trading strategies.

- Multi-timeframe analysis for comprehensive insights.

- Cloud-based platform for accessibility.

The Bad

- Learning curve for beginners.

- Requires a subscription for advanced features.

How to Choose the Right Stock Trading App for You

It is essential to select the appropriate stock trading app in order to have a trading experience that is both positive and productive. The following is a guide that will assist you in selecting the stock trading app that is most suitable for you:

- Determine Your Needs: Determine the requirements and priorities that you have for trading. Take into consideration a variety of aspects, including the kinds of securities you intend to trade (stocks, options, and cryptocurrencies), the frequency with which you intend to trade, and the features that you require.

- User-Friendly Interface: Select an application that has a user-friendly interface on your device. It is especially important that the platform be user-friendly and simple to navigate if you are just starting out.

- Ensure that the app supports the sort of securities that you intend to trade by checking the “Supported Securities” section. While there are apps that focus solely on equities, there are others that provide a wider choice of alternatives, exchange-traded funds (ETFs), and cryptocurrencies.

- Examine the fee structure, which includes both fees and commissions. Look for apps that have commission rates that are minimal or even nonexistent, particularly if you want to make transactions on a regular basis. There are additional fees to take into consideration, including account maintenance fees, inactivity fees, and withdrawal fees.

- Minimums for Accounts: Determine whether or not the application has minimum deposit requirements. For certain platforms, a minimum quantity is required in order to create an account.

- Research Tools: Conduct an analysis of the research tools and resources that are made available by the application. When it comes to making educated selections about trading, it is important to look for real-time market data, financial news, analysis, and research studies.

- Charting capabilities: If you intend to use technical analysis as part of your trading strategy, you should be sure that the app provides you with powerful charting capabilities. Keep an eye out for features such as sketching tools, numerous timeframes, and technical indications.

- Order kinds: Examine the various order kinds that are offered. Market orders and limit orders are examples of basic order types. However, advanced traders may demand extra choices such as stop-loss orders or conditional orders that are not available to most traders.

Questions and Answers

One of the most popular choices for trading in the Indian market is the Apple iPhone. iPhones are well-known for their powerful CPUs, high-quality screens, and extended battery life. These characteristics make them an excellent alternative for traders who need to manage many programmes and make decisions quickly.

The use of mobile applications for trading is completely risk-free because they adhere to the majority of the same safety requirements as web-based portals. For the purpose of authorising transactions, they also offer extra layers of protection, such as fingerprint scanners and two-step authentication.