Table of Contents

The choice of the appropriate instrument can make a world of difference when it comes to the management of one’s financial affairs. You Need a Budget (also known as YNAB) and Mint are two well-known examples of personal finance software that can assist you in regaining command of your financial situation. During this comparison, we will look into the merits and disadvantages of each platform, providing you with vital information that will enable you to make an informed choice.

YNAB is well-known for its proactive budgeting method, which places an emphasis on taking responsibility for one’s financial situation, whereas Mint provides a comprehensive financial summary, most of the time at no cost. When you reach the conclusion of this essay, you will have a crystal clear idea of which approach is more in line with the financial goals and lifestyle that you have set for yourself.

Ynab vs Mint Comparison Table

YNAB (You Need A Budget) and Mint are apps that help you make a budget. YNAB works on budgeting in a proactive way and gives you tools for detailed control and financial planning. Mint is free and easy to use, and it gives you an overview of your funds.

| Specification | YNAB | Mint |

|---|---|---|

| Budgeting Approach | Proactive, manual entry | Automated, effortless |

| Pricing | Subscription-based | Free with optional ads |

| Platform Compatibility | Web, mobile apps (iOS/Android) | Web, mobile apps (iOS/Android) |

| Budgeting Methodology | Zero-based budgeting | Category-based budgeting |

| Investment Tracking | Limited | Yes, basic investment tracking |

| Customer Support | Email support, tutorials | Email support, FAQs |

| Download Now | Download Now |

What is YNAB?

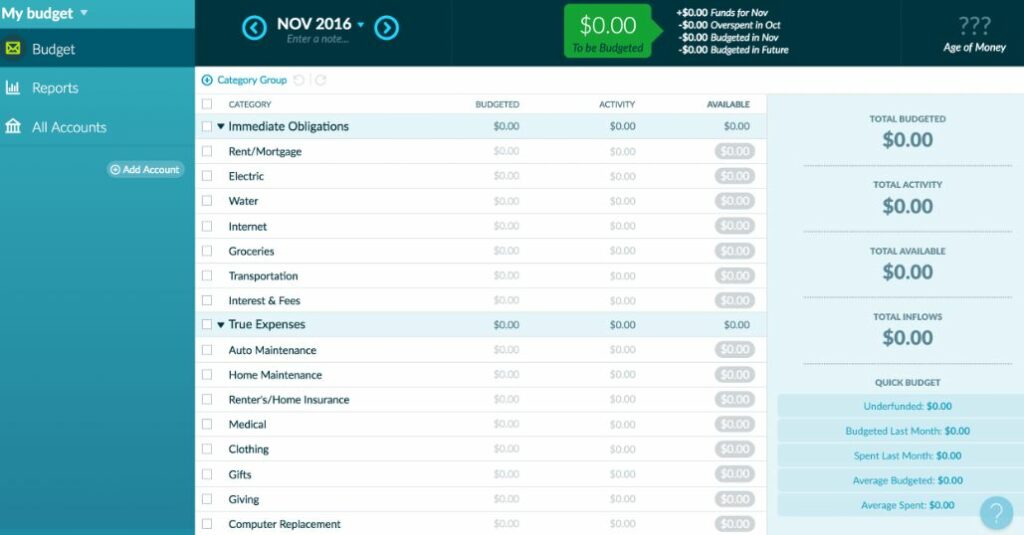

You Need A Budget (YNAB) is a piece of software for budgeting and managing personal money that can assist you in regaining control of your financial situation. YNAB was established in 2004 and uses a zero-based budgeting strategy, which means that every dollar you earn is allocated to a specific purpose. The software is designed to assist customers in successfully prioritizing their spending and distributing their revenue across a variety of spending areas.

What is Mint?

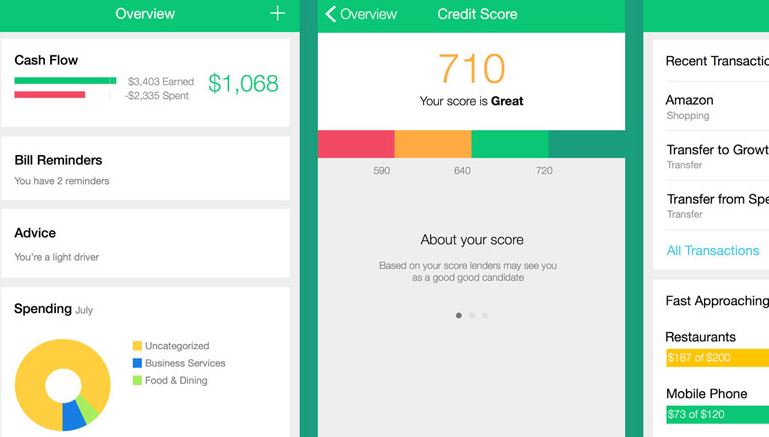

In 2006, Intuit, the company that is best known for producing TurboTax and QuickBooks, purchased Mint, which is a web-based personal finance platform that is free to use. The major purpose of Mint is to present users with an overview of their financial status by compiling data from a user’s numerous accounts, such as bank accounts, credit cards, loans, and investments. This data is aggregated on a user’s own dashboard.

Ynab vs Mint: User Interface

The user-friendly design of YNAB is centered on real-time tracking and budgeting categories. Because it makes managing a budget easier, it is ideal for users of all expertise levels, from novices to experts. Because of its emphasis on proactive budgeting and the concepts of zero-based budgeting, users are encouraged to allocate every dollar on purpose by using this tool.

On the other hand, Mint presents an overview of one’s financial situation through the use of visually appealing charts and graphs. The majority of its customers will find that its user interface, which provides a rapid summary of their current financial condition, is easy to understand. Those individuals who are looking for a hands-free method of budgeting will find Mint to be a useful tool because it automatically classifies transactions and keeps track of spending.

Ynab vs Mint: Budgeting Methodologies

YNAB employs a method of budgeting known as zero-based budgeting, in which each and every dollar of income must be assigned to particular categories or functions. Because users actively manage their money by allocating it to specific tasks, this strategy helps users avoid overspending and encourages them to save money. It also encourages a high level of accountability and prioritizing with regard to their finances.

Mint, on the other hand, utilizes a method of tracking expenses and income that is more conventional. Although it permits users to set budget restrictions for a variety of categories, it does not mandate that each and every dollar be allocated to a particular project. This strategy offers flexibility, but it may need more self-discipline to avoid overspending because there is no inherent rule to ensure that each and every dollar is accounted for.

Ynab vs Mint: Security and Privacy

Both YNAB (You Need A Budget) and Mint place a high priority on the safety of their users’ personal financial information. To do this, they implement security protocols on par with those used by banks as well as encryption.

YNAB focuses a significant amount of importance on security, and in order to improve the account protection it provides, it employs stringent procedures such as two-factor authentication (2FA). It’s important to note that YNAB does not engage in the practice of selling user data, which ensures users’ privacy.

In addition, user data is encrypted and protected by security protocols comparable to those used by banks. However, as a trade-off for its free service, it may display advertisements and make recommendations for financial products depending on the user’s current financial condition. This could be considered as a negative aspect of the service.

Ynab vs Mint: Mobile Apps

The mobile apps developed by YNAB are well-known for their extensive feature sets, which enable users to access their budgets, enter transactions, and easily monitor their progress toward achieving their financial goals. It is an excellent option for individuals who are dedicated to active budget management because of its user-friendly design and extensive capabilities, which give a handy way for users to monitor and alter their financial plans whenever and wherever they choose.

Additionally, Mint offers mobile applications for users of the iOS and Android operating systems. Mint’s mobile apps have been noted by some users to be slightly less intuitive than YNAB’s mobile apps, despite the fact that Mint’s mobile apps are useful and convenient. However, Mint’s applications still offer useful capabilities for tracking spending and financial snapshots, which makes them acceptable for users who prefer a more hands-off approach to budgeting on their mobile devices. This makes Mint’s apps suitable for users who like to track their expenses and financial snapshots on their mobile devices.

Which is better?

YNAB or Mint is better for you relies on what you want to do with your money and how you like to organize it. YNAB is great at proactive budgeting because it emphasizes careful planning and entering transactions by hand. This makes it perfect for people who want to handle their money themselves. It costs money, but it gives you strong tools for getting your finances in order. On the other hand, Mint gives you a complete picture of your finances with little effort. This makes it a good choice for people who want a simple outline of their finances. It’s often free, but there may be ads on it. In the end, YNAB is better for people who want to be more involved and in charge of their finances, while Mint is better for people who want a less hands-on, more automated method.

Ynab: The good and The bad

Mastering YNAB can be challenging, but the program offers a wealth of educational tools, including tutorials and philosophical writings.

The Good

- Encourages hands-on budgeting and financial awareness.

- Promotes a proactive approach to managing money.

The Bad

- Limited investment tracking capabilities.

Mint: The good and The bad

You can manage almost every aspect of your personal finances using Mint, from your income and expenditures to your credit score, and it costs you very nothing to use.

The Good

- Provides an effortless overview of finances.

- Typically free to use, with optional ads.

The Bad

- May display ads, which can be distracting.

Questions and Answers

The main difference between them is how they handle money in general. YNAB has a unique, forward-thinking approach to budgeting, while Mint puts all of your accounts in one place so you can see your whole financial picture.

Mint is better suited for expense tracking and providing insights into spending habits as it automatically categorizes transactions from linked accounts.