Table of Contents

Our society moves quickly, and getting rich takes up a lot of our time and energy. As a result, managing our money well often falls by the wayside. With all the activity going on, it’s simple to spend more than we have and forget to save. The good news is that things are changing. The rise of personal finance apps in India is a sign of hope for people who want to be financially stable and independent.

These cutting-edge apps are great for getting your finances in order because they make it easy to keep track of your income and expenses. By using the power of technology, people now have a powerful tool to help them figure out their complicated finances. By using these apps regularly, you can not only keep track of your financial transactions, but you can also learn more about your spending habits and patterns.

People are managing their money in very different ways now that personal finance apps are popular. We no longer have to rely only on old-fashioned methods; instead, we can use the ease and speed of digital solutions to get smarter about money. When people use these apps, they start a journey that changes their lives and helps them learn about money and gain power.

Best Personal Finance Apps in India Comparison Table

People don’t have much time to keep track of their money these days. These are the times when money and finance apps can help you handle your money better. Several apps can keep track of all of your income and expenses, as well as your investments, and give you advice on how to handle your money.

| Feature | Wallet | Dhani App | Walnut (Now AXIO) | Monefy | Money Manager |

|---|---|---|---|---|---|

| Primary function | Personal finance management | All-in-one finance app (payments, investments, credit cards) | Personal finance management & bank aggregation | Personal finance management | Personal finance management |

| Supported platforms | Android, iOS | Android, iOS | Android, iOS | Android, iOS | Android, iOS |

| Free features | Budgeting, expense tracking, account linking | Bill payments, investment tracking, credit card rewards, coupons | Account aggregation, expense categorization, budgeting reports | Expense tracking, budget goals, recurring transactions | Expense tracking, income tracking, debt tracking |

| Paid features | Premium features like advanced budgeting, custom categories | Additional investment options, premium credit card benefits | Premium features like automatic expense categorization, financial goals tracking | Premium features like account syncing across devices, unlimited budgets | Premium features like custom reports, cloud backups |

| Unique features | Bill splitting, bill reminders | Medicine delivery, healthcare services, travel bookings | Smart categorization, expense tagging, AI-powered insights | Minimalist interface, focus on user privacy | Extensive customization options, currency conversion |

Best Personal Finance Apps in India

The best apps for managing your money don’t just help you keep track of your spending, look at spending patterns, or make budgets for all of your bank accounts; they also give you a lot of information about those things. Because they let you do these things, personal finance apps help you grow your money. It also gives you tax advice and a number of different investment options.

Wallet

| Feature | Description |

|---|---|

| Expense Tracking | Keep track of your spending across various categories |

| Budgeting | Set and manage budgets for different expenses |

| Bill Reminders | Receive notifications for upcoming bill payments |

| Financial Goals | Set and track progress towards financial objectives |

| Sync Across Devices | Access your financial data from multiple devices |

| Google Play Store |

Wallet is my personal finance partner after years of managing my finances. The app is like a pocket financial counsellor. Wallet organises my finances by recording income and categorising expenses. Its easy-to-use UI and automatic transaction feature save me time. However, its budgeting tools set Wallet apart. Whether I’m saving for a large purchase or cutting back, Wallet gives me the information and resources I need to reach my financial objectives.

The Good

- User-friendly interface

- Comprehensive expense categorization

- Multi-device synchronization

The Bad

- Some advanced features require premium subscription

- Limited customization options for reports

Dhani App

| Feature | Description |

|---|---|

| Instant Loans | Apply and receive loans quickly with minimal paperwork |

| Bill Payments | Pay bills for various services conveniently |

| Insurance | Purchase and manage insurance policies |

| Investments | Invest in mutual funds and other financial products |

| Cashback Offers | Avail cashback rewards on transactions |

The Dhani App transformed my financial management. Tracking spending is no longer enough—you need a complete financial environment. Dhani lets me manage my credit cards, investments, bills, and healthcare spending in one spot. Remember the prizes! Dhani’s loyalty program rewards regular purchases, giving me cashback and exclusive advantages. This is like saving for the future with daily expenditure. Dhani empowers me to manage my finances and make smart choices for a better future.

The Good

- Swift loan approval process

- Diverse financial services offered

- Attractive cashback offers

The Bad

- Limited availability of services in certain regions

- Interface can be cluttered for first-time users

Walnut (Now AXIO)

| Feature | Description |

|---|---|

| Automated Expense Tracking | Automatically track expenses using bank transactions |

| Group Expense Sharing | Split bills and expenses with friends effortlessly |

| Bill Reminders | Receive alerts for upcoming bill payments |

| Insights & Analytics | Gain insights into spending habits and trends |

| Secure Transactions | Ensure safety and security of financial transactions |

Walnut, AXIO is my longtime financial partner. I can see my entire financial picture thanks to its flawless connectivity with all my Indian bank accounts. However, its clever analytics and auto-categorization set AXIO unique. AXIO gives me unprecedented insights into my spending habits and helps me allocate my resources. AXIO provides budgeting tools and personalised financial guidance to help me manage my finances and reach my goals. I feel confident and in charge of my finances using AXIO.

The Good

- Seamless expense tracking through bank integration

- Simplified bill splitting with friends

- Robust insights and analytics features

The Bad

- May not support all banking institutions

- Occasional synchronization issues with bank accounts

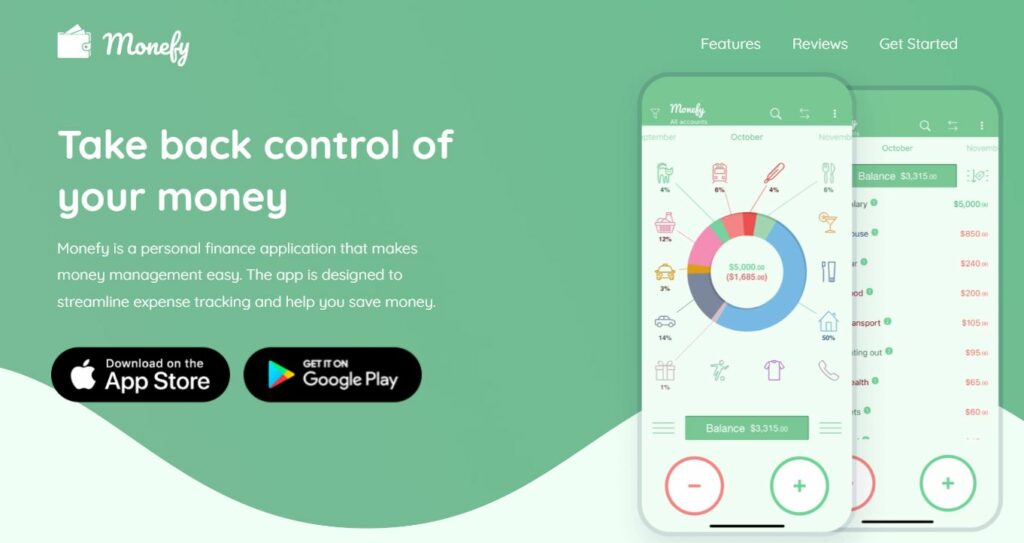

Monefy

| Feature | Description |

|---|---|

| Easy Expense Entry | Quickly add expenses with simple interface |

| Budget Tracking | Monitor spending against preset budgets |

| Multiple Accounts | Manage expenses across different accounts |

| Data Backup | Backup and restore financial data for security |

| Currency Support | Track expenses in multiple currencies |

Monefy is the best way for me to keep track of my spending. It’s easy to keep track of costs on the go thanks to its simple layout and simple interface. Monefy’s clean style and easy-to-use features make it easy for me to track my monthly budget or put my spending into categories. With Monefy, I can learn useful things about how I spend my money without being slowed down by too much information. It’s like having a personal business assistant who gets that I want things to be simple and clear.

The Good

- Intuitive and easy-to-use interface

- Support for multiple accounts and currencies

- Convenient data backup feature

The Bad

- Lack of advanced features compared to other apps

- Limited customization options for categories

Money Manager

| Feature | Description |

|---|---|

| Expense Tracking | Keep detailed records of all expenses |

| Income Management | Track and manage various sources of income |

| Budget Planning | Plan and stick to budgets for different categories |

| Reports & Analysis | Generate insightful reports and analysis |

| Sync Across Devices | Access financial data from anywhere |

Money Manager is like having a Swiss army knife for your finances. It meets all of my different financial goals and has many tools to help me keep track of my money. Money Manager has everything you need to keep track of your income and costs, set spending goals, and get timely bill reminders. This item is unique because it can be used in many ways.

Money Manager easily changes to fit my needs, whether I just want to keep track of my expenses or need a powerful way to organise my money. Money Manager gives me the tools I need to make smart financial choices and reach my financial goals, with advanced features like tracking my debt and making reports that fit my needs.

The Good

- Comprehensive expense tracking capabilities

- Robust budget planning tools

- Seamless synchronization across devices

The Bad

- Steep learning curve for new users

- Interface could be more modern and visually appealing

Benefits of Using Personal Finance Apps in India

For people in India who want to better manage their money, using personal finance apps has a number of benefits:

- Budgeting and Keeping Track of Expenses: Personal finance apps help people make budgets and keep real-time records of their spending. These apps help users find ways to save money by sorting transactions into groups and showing them how they usually spend their money.

- Setting financial goals: A lot of personal finance apps let users set goals like saving for a trip, getting a new car, or having enough money saved for emergencies. People can use these apps to keep track of their progress towards their goals and stay motivated to stick to their spending and saving plans.

- Reminders for Bill Payments: Personal finance apps often have alerts and reminders for bill payments to help users stay on top of their financial obligations, like loan EMIs, credit card payments, and other bills. This feature can help users keep their credit score high by preventing missed payments and late fees.

- Investment Management: Some personal finance apps have features for tracking investments and managing portfolios, so users can keep an eye on how their investments are doing and how their assets are being used. From a single platform, users can keep an eye on stocks, mutual funds, fixed deposits, and other types of investments.

- Expense Analysis and Insights: Personal finance apps look at how users spend their money and give them information about how they handle their money. These apps help people make smart choices about their money by showing them spending patterns and trends. They also show them where they can make improvements.

- Goal-Based Saving: Many personal finance apps let users set savings goals and divide their money into different categories for different uses. Whether people are saving for a house down payment or an emergency fund, these apps help them set priorities for their money goals and make sure they get the money they need.

- Share and Split Expenses: Some personal finance apps let users share and split expenses, which makes it easier to split bills with roommates or friends. This feature makes it easier to pay for group costs and makes sure that everyone does their fair share.

- Security and Privacy: Personal finance apps put security and privacy first by encrypting and using other security measures to keep users’ financial information safe. Users can safely get to their financial information by using PIN codes or biometric authentication.

Questions and Answers

The vast majority of budgeting apps have robust security systems in place and are open and honest about the manner in which they safeguard your monetary information. If you are using public Wi-Fi, you should strive to avoid reusing passwords and should avoid connecting to any financial apps.

Also, don’t use budgeting apps or other third-party tools for managing your money on public WiFi networks. These networks are usually not as safe and could leave you open to hacking. When you use any kind of third-party tool, make sure you treat account security as an ongoing step in your financial journey.