Table of Contents

The utilisation of the power of money-saving apps can significantly expedite the process of achieving financial goals, whether it be the establishment of an emergency fund for the purpose of covering unforeseen expenses or the accumulation of funds for that dream vacation that you have been yearning for. Using my own experiences as a guide, I’ve found that these applications make use of a wide variety of cutting-edge methods to simplify the process of saving money.

As a result, what can at times appear to be a challenging endeavour is transformed into an experience that is both interesting and rewarding. It is possible to find an app that caters to the specific preferences and patterns of saving that are unique to each individual, ranging from user-friendly budgeting tools to automatic savings features.

I have personal experience with a number of these applications, and I can attest to the fact that they are effective in enhancing one’s bank account and fostering a more positive outlook on one’s financial situation. It doesn’t matter if you’re a seasoned saver looking to optimise your strategy or if you’re just starting out in the world of financial planning; these carefully selected apps are sure to become indispensable allies on your journey towards achieving financial success.

How to use apps to save money

There are different ways that money-saving apps can help you save. One way is to round up your purchases and put the extra money in a savings or investment account. Some offer budgeting tools to help you stick to your spending and saving plans, while others let you set your own goals to keep you going.

Best Money-Saving Apps Comparison Table

Saving is one of the smartest things you can do for your family. It provides peace of mind, supports your financial goals, and provides an emergency cushion. Most importantly, saving money means taking charge of your future. It shows you’re willing to sacrifice now for a better future—one where you can buy a home, retire comfortably, or enjoy life with a financial cushion.

| Feature | Oportun | Qapital | BillTrim | Goodbudget | Current |

|---|---|---|---|---|---|

| Target audience | Credit-challenged individuals | Young adults, students | Cost-conscious individuals | Budget-conscious individuals | Everyday banking users |

| Primary service | Secured credit card for building credit | Goal-based savings and investing | Automatic bill negotiation and expense tracking | Budgeting and expense tracking | Checking and debit account with fee-free features |

| Fees | Annual fee and interest on credit card | Monthly subscription fee | Subscription fee (optional) | Free and premium versions | Monthly membership fee |

| Ideal for | Individuals rebuilding credit or with limited credit history | Young adults starting to save and invest | Cost-conscious individuals looking to lower bills | Budget-conscious individuals prioritizing financial planning | Everyday banking users seeking fee-free features and cashback rewards |

Best Money-Saving Apps

We looked at mobile apps that had features that were meant to make saving money simple or automatic. Some examples of attributes are round-ups for saving spare change, cash-back offers for saving on everyday purchases, and savings goals that users can change to stay motivated.

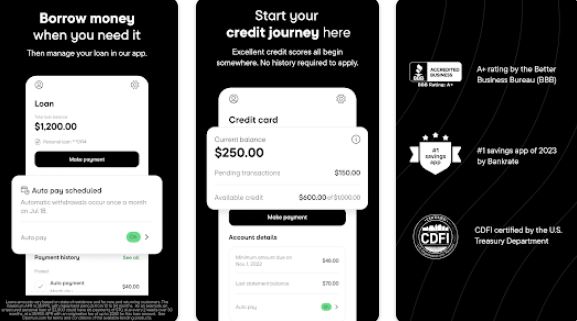

Oportun

| Feature | Description |

|---|---|

| Easy Signup | Quick and straightforward registration process |

| Personalized Offers | Tailored loan options based on individual needs |

| Financial Education | Access to resources for better financial management |

| Mobile App | Convenient account management on the go |

| Google Play Store |

Due to the fact that I have personal experience in navigating the financial landscape, I have found a multitude of tools that are extremely helpful and are specifically designed for underserved communities such as Oportun.

Not only does this neobank offer essential financial products, but it also makes use of alternative data, which is a boon for people like myself who have a limited credit history.

The Good

- Easy signup process

- Personalized loan offers

- Access to financial education

The Bad

- Limited availability in certain regions

- May have higher interest rates for some borrowers

Qapital

| Feature | Description |

|---|---|

| Goal Setting | Set savings goals and track progress |

| Automated Saving | Round up purchases and save spare change |

| Custom Rules | Create personalized savings rules |

| Team Saving | Collaborate with friends and family for shared goals |

The remarkable mobile application known as Qapital has been of great assistance to me on my path towards achieving financial stability. I was able to automate my savings and investments by setting up rules that automatically transfer spare change or a percentage of my paycheck into my savings account. This was made possible by the user-friendly interface of the software.

The Good

- Flexible goal-setting options

- Automated saving features

- Customizable rules for savings

- Collaborative saving with others

The Bad

- Some features may require premium subscription

- Limited integration with certain financial institutions

BillTrim

| Feature | Description |

|---|---|

| Bill Negotiation | Automated negotiation to lower bills |

| Bill Tracking | Monitor bill payments and due dates |

| Savings Alerts | Receive notifications for potential savings opportunities |

| Customized Plans | Tailored recommendations for bill reduction |

The tool known as BillTrim stands out as a game-changer among the many tools available. Through its creative strategy of negotiating lower rates with service providers, I have been able to save a significant amount of money on my medical bills.

As an additional benefit, its tracking capabilities have illuminated areas in which I can reduce my expenditures, which has enabled me to make more informed choices regarding my finances.

The Good

- Automated bill negotiation

- Simplified bill tracking

- Savings alerts for potential savings

- Personalized plans for bill reduction

The Bad

- Not available for all bill types

- Limited ability to negotiate certain bills

Goodbudget

| Feature | Description |

|---|---|

| Envelope Budgeting | Allocate funds into virtual envelopes |

| Expense Tracking | Monitor spending habits and trends |

| Sync Across Devices | Access budget from multiple devices |

| Debt Payoff Tracker | Track progress on debt repayment |

Over time, Goodbudget has become a reliable partner. By utilising the envelope method, this application organises my income into various categories, which enables me to allocate funds for essentials such as rent, food, and transportation.

The user-friendly interface makes it easy to keep track of expenses and establish goals that are within my reach, which ultimately leads to my achieving financial success.

The Good

- Envelope budgeting for better control

- Detailed expense tracking

- Syncing across multiple devices

- Debt payoff tracking feature

The Bad

- Basic version may have limited features

- Manual input required for some transactions

Current

| Feature | Description |

|---|---|

| Fee-Free Banking | No monthly fees or minimum balance requirements |

| Early Direct Deposit | Get paid up to two days early |

| Budgeting Tools | Set budgets and track spending |

| Mobile Check Deposit | Deposit checks remotely using the mobile app |

Because of its extensive feature set, Current has completely transformed the way I interact with my financial institution. This app for mobile banking has become indispensable, as it can be used for everything from checking and savings accounts to debit cards and cashback rewards.

In addition, the flexibility granted by the ability to overdraft without incurring fees and to receive early payments has been of great assistance to me in the management of my finances.

The Good

- Fee-free banking

- Early direct deposit feature

- Budgeting tools for financial management

- Convenient mobile check deposit

The Bad

- Limited physical branch locations

- May not offer certain traditional banking services

Criteria for Selecting the Best Money-Saving Apps

Consider these criteria when choosing the best money-saving apps to ensure they meet your financial goals and preferences:

- To better manage your finances, look for apps with robust budgeting and expense tracking features. Setting budget categories, tracking spending in real time, and analysing financial habits to save money should be possible with the app.

- Consider apps that help you set financial goals and create personalised savings plans. The app should help you set goals, track progress, and stay motivated when saving for a purchase, emergency fund, or debt repayment.

- Automatic Savings: Use apps with automated savings to save money easily. Schedule recurring transfers, round up purchases to the nearest dollar, or automatically deposit part of your income into a savings account. Automated savings make saving habits easy without thinking.

- Cashback and Rewards: Find apps with cashback, discounts, or incentives for everyday purchases. The app should maximise savings on regular spending while earning rewards or bonuses through retailer partnerships, credit card rewards programmes, or cashback offers.

- Bill Negotiation Services: Use apps to negotiate cable, internet, and subscription bills to save money. These apps analyse your bills, negotiate with providers, and get you lower rates or discounts on essential services.

- Investment and Retirement Planning: Consider apps that help you build long-term wealth. The app should offer investment accounts, retirement calculators, portfolio analysis, and risk- and goal-based investment recommendations.

- Security and Privacy: Protect your financial and sensitive data with secure apps. Apps with strong encryption, multi-factor authentication, and data protection can protect your accounts and transactions from fraud.

- User Interface and Ease of Use: Choose apps with simple interfaces and features for mobile financial management. The app should be easy to use, attractive, and accessible on smartphones, tablets, and desktops.

Questions and Answers

The use of money-saving apps is becoming an increasingly popular method for individuals to save money since they eliminate the need for them to manually monitor their finances on a monthly basis. Whether you go with a high-yield savings account like Chime or an app like Digit or Acorns, you should make sure to pick a choice that is compatible with your way of life.

Simply put, the objective of the Challenge is to save one hundred dollars over the course of thirty days by making a series of deposits that gradually increase in size. Because there are thirty days in November, each day is a day of savings. Daily savings deposits begin at one dollar per day for a period of five days, to be followed by deposits of two dollars, three dollars, and four dollars each for a period of five days.