Table of Contents

Learn how to Calculate APR in Excel in this guide. The Annual Percentage Rate (APR) of a loan provides information regarding the total cost of borrowing money over the course of one year. In contrast to simply the interest rate, it will take into account all of the other costs and fees that are associated with obtaining a loan. Because of this, the annual percentage rate, also known as the APR, will be higher than the interest rate. In the event that there are no further costs involved, the total amount will remain the same.

We are going to show you how to calculate the annual percentage rate (APR) in Excel, as well as how it compares to the interest rate by itself, in this post. Calculating the annual percentage rate (APR) with Microsoft Excel can make determining the interest rate for a loan or credit card a breeze. The annual percentage rate, or APR, is the annual interest rate that is charged by a lender or credit card issuer to borrow money. This rate takes into account all fees, including those for the loan’s origination, processing, and annual account.

The annual percentage rate (APR) is typically presented as a percentage calculated over the course of one year. In this article, we will walk you through the process of calculating the APR using Excel. Excel provides a straightforward function that makes it possible to compute the annual percentage rate (APR) in a snap and with little effort; you won’t have to struggle with the intricate formulas for calculating APR that you might find on the internet. The most important thing is to determine the inputs that you will be using and the variables that will be involved in the calculation. We mentioned below are the steps how to Calculate APR in Excel.

What Is APR?

The annual cost of borrowing money is referred to as the annual percentage rate (APR), which is expressed as a percentage. It takes into account not only the interest rate but also any other fees connected to the loan, such as origination fees, points, and closing costs. Because it takes into account all of the fees that are associated with borrowing money, the annual percentage rate (APR) is a more accurate measurement of the true cost of a loan than the interest rate alone.

On all consumer loans, including credit cards, mortgages, and personal loans, the annual percentage rate (APR) must be disclosed by the lending institution. The Truth in Lending Act (TILA), which is a federal law that protects consumers from unfair lending practices, requires that this be done. TILA is an acronym for Truth in Lending Act. When comparing various loan options, the annual percentage rate (APR) is an important factor to take into consideration. You can get a better idea of the actual cost of each loan by comparing the annual percentage rates (APRs) of the various loans available to you and selecting the loan that meets your needs the most effectively.

How to Calculate APR in Excel

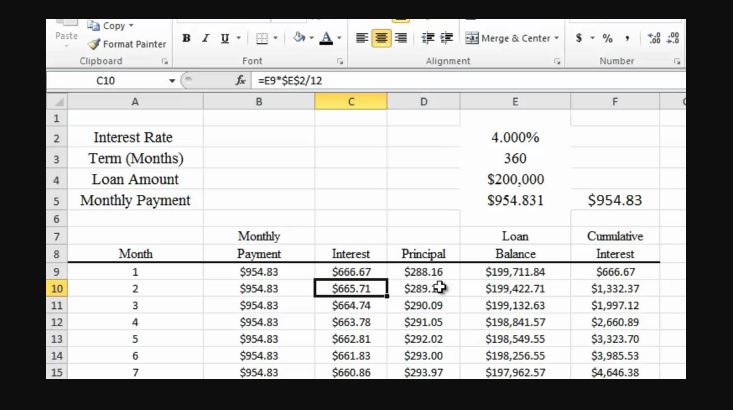

- Use the “RATE” function in Excel to find the APR.

- Type “=RATE(” into a blank cell.

- Here’s the format: “=RATE(number of repayments, payment amount, value of loan minus any fees required to get the loan, final value).”

- Once more, the last number is always zero.

- Any fees should be taken out of the loan’s value because that’s how much you’re borrowing.

- When you borrow $2,400 and pay $100 in fees, you’re really only borrowing $2,300.

- To get the rate, use the same example again: type “=RATE(48, -76.08, 2300, 0)”.

- For the second part, you don’t have to copy the figure by hand; you can just click on the cell you used for the “PMT” function.

- To get the real APR, multiply this number by 12.

- Type “=RATE(48, -76.08, 2300, 0)*12″ to get the answer you need.

- To use the APR example again, this equals 25% APR.

The Importance of Calculating APR

- Transparency: The APR makes financial transactions clear by showing all the costs of a loan, like interest, fees, and other charges. It gives borrowers the information they need to compare different loan offers and make smart choices.

- Cost Comparison: Borrowers can accurately compare loans or credit offers from different lenders by figuring out the APR. This helps them pick the best deal, which saves them money in the long run.

- Making a Better Budget: APR helps people make better budgets because it shows them exactly how much their monthly and yearly loan costs. This information is very important for managing personal finances and staying away from debt.

- In many countries, lenders are required by law to include the APR in loan agreements. This is to protect borrowers from predatory lending and fees that aren’t disclosed.

- Protection for Consumers: The APR calculation protects consumers by stopping lenders from hiding high interest rates by advertising low rates. It gives people the information they need to make smart financial choices.

- Investment Choices: When it comes to investments, APR helps people figure out how much money they might make from things like bonds, savings accounts, and CDs. It helps you make smart decisions about investments.

- Compliance with regulations: Many banks and other lenders have to follow regulations about giving out APR information. These institutions stay in line with the law by correctly calculating and sharing the APR.

Calculating APR Using Excel Functions

| Step | Description | Excel Function | Formula/Example |

|---|---|---|---|

| 1 | Enter the number of repayments | Number of Repayments | 48 |

| 2 | Enter the payment amount | Payment Amount | -76.08 |

| 3 | Enter the loan amount | Loan Value (excluding fees) | 2300 |

| 4 | Enter any fees required to get the loan | Fees | 100 |

| 5 | Calculate the adjusted loan amount by subtracting fees | Adjusted Loan Value | =Loan Value – Fees = 2300 – 100 = 2200 |

| 6 | Calculate the rate using the RATE function | APR Rate | =RATE(Number of Repayments, Payment Amount, -Adjusted Loan Value, 0) =RATE(48, -76.08, -2200, 0) |

| 7 | Calculate the APR by multiplying the rate by 12 | Annual Percentage Rate (APR) | =APR Rate * 12 |

Conclusion

If you run a business, you might find yourself in a position where you need to borrow money from banks and other financial institutions so that your company can continue to grow. These institutions generate revenue by charging the borrower a predetermined fee as a percentage of the total amount of the loan. The total cost that the borrower pays to the bank over the course of a year is referred to as the annual percentage rate (APR).

This mathematical calculation might have seemed challenging to you in the past, but not anymore. Excel allows you to calculate the annual percentage rate if you have accurate data. We will explain how to calculate the annual percentage rate (APR) in Excel in this article that we are writing for you today. If you want to know more information about this visit Microsoft Excel official Website.

Questions and Answers

=IPMT(5%/12, 1, 60, 50000) is the formula that will be utilized in this process. Regarding the preceding illustration: It was necessary to convert the annual interest rate of 5% into a monthly rate (=5%/12), as the payments are made on a monthly basis. Additionally, it was necessary to convert the number of periods from years to months (=5*12).

What exactly is the PMT function that’s available in Excel? The PMT function in Excel is a financial function that calculates the payment for a loan based on a constant interest rate, the number of periods, and the amount of the loan. This calculation is done in accordance with the loan amount. The name of this function comes from the acronym “PMT,” which stands for “payment.”

Both annual percentage rate (APR) and annual percentage yield (APY) measure the interest that is accrued. The annual percentage rate, or APR, is typically associated with credit accounts. When your account’s annual percentage rate (APR) is lower, the likelihood is that your overall cost of borrowing will also be lower. The annual percentage yield (APY) is typically associated with deposit accounts.