Table of Contents

My experience has taught me that GoCardless is committed to bringing about a paradigm shift in the payment processing industry. Their objective is to emancipate both individuals and businesses from the burdens and expenses linked to antiquated payment systems. GoCardless offers a streamlined and reliable solution for facilitating direct bank payments.

GoCardless has provided me with the seamless ability to process automated recurring transactions and accept one-time payments. Using their supplementary functionalities, I have been able to effectively mitigate fraudulent activities and recover over 70% of failed payments—all while maintaining my customers’ payment experience uncompromised. As a result, substantial time and financial savings have been realised, along with enhanced customer retention, punctual payments, and a decrease in tension levels.

The fact that GoCardless processes payments for more than 75,000 organisations globally, including DocuSign, Carrefour, and UNHCR, is even more remarkable. Their annual processing capacity exceeds $30 billion, and I have observed their services to be exceptionally versatile. Their products are accessible via an intuitive online interface, integrate seamlessly with an extensive array of pre-existing business systems, and even permit the development of custom integrations via their API, thereby offering unparalleled adaptability to meet your particular requirements.

GoCardless Specifications

A payment processing platform that specialises in the handling of recurring payments is known as GoCardless. It gives companies the ability to automate and streamline the processes involved in recurring billing.Payments for subscriptions are made more efficient by GoCardless since the company collects payments directly from the bank accounts of consumers. This lowers the danger of payments being declined and increases productivity.

| Feature | Specification |

|---|---|

| Supported currencies | GBP, EUR, USD, SEK, DKK, AUD, NZD, CAD |

| Transaction fees | 1% + £/€0.20 per transaction for the Standard plan, and 1.25% + £/€0.20 per transaction for the Advanced plan. An additional fee of 0.3% applies to UK Bank Debit payments above £ 2,000. |

| Recurring payments | Yes |

| Integrations | Integrates with a variety of accounting software and other business tools |

| Visit Website |

What is GoCardless?

GoCardless automates and simplifies corporate recurring payments. It lets businesses collect customer payments via direct debits, ACH, or bank-to-bank transfers. This service is useful for subscription-based, recurring billing, and regular payment firms.

GoCardless connects to consumers’ bank accounts to streamline regular payments including subscriptions, club dues, utility bills, and more. It streamlines corporate payment collection by reducing failed payments and late fees. GoingCardless is noted for its simplicity, worldwide payment options, security, and data protection compliance. It works for organisations of all sizes and sectors who need a reliable and automatic recurring payment solution.

GoCardless review: Features

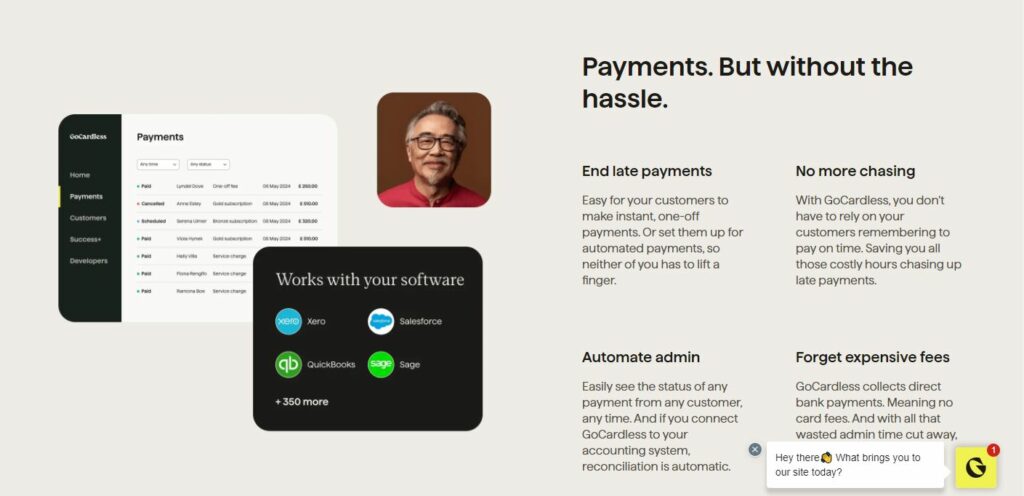

In my experience, GoCardless has been a great money collection option. It can handle one-time or recurring payments and doesn’t bind you into long-term commitments, making it flexible for your organisation. I like GoCardless’s automation, which connects to consumers’ bank accounts for swift, trustworthy collections to avoid late payments. It serves over 30 countries, making it ideal for multinational businesses.

GoCardless deposits payments within 1-3 business days, maintaining steady cash flow. Financial processes are simplified by its seamless integration with accounting software and key tools. Real-time payments and cash flow analytics improve financial decision-making. Customers can use Direct Debit, credit, and debit cards.

GoCardless review: Recurring Payments

One of the most common payment gateways used for recurring payments is GoCardless. Direct Debit is a payment method that enables companies to collect payments from clients by taking money straight from their bank accounts. Customers can make payments for recurring subscriptions, memberships, and other services using this method, which is both convenient and safe to do so.

GoCardless review: Customer Support

Phone, email, and live chat help are available from GoCardless. The 24/7 support crew is usually responsive. Customer reviews rate GoCardless’s customer support highly. Customers like that the team is available 24/7 and responsive. They like that the personnel is knowledgable and helpful. GoCardless’s customer assistance has disappointed several customers. Some customers say it’s hard to reach a representative and they’re not always helpful.

GoCardless review: Pricing Options and Supported Currencies

GoCardless offers two payment collection plans: Standard and Advanced, each adapted to business needs. The Standard plan charges 1% and £/€0.20 every transaction. Note that the transaction cost is restricted at £/€4. UK Bank Debit payments over £2,000 incur a 0.3% charge. The Standard plan charges 2% on top of the £/€0.20 transaction fee for international transactions.

The Advanced plan adds 1.25% to the £/€0.20 transaction fee. This plan caps transaction fees at £/€5. UK Bank Debit payments over £2,000 incur a 0.3% fee, like the Standard plan. International Advanced plan transactions incur a 2.25% cost on top of the £/€0.20 transaction fee.

Note that GoCardless accepts GBP, EUR, USD, SEK, DKK, AUD, NZD, and CAD. Currency flexibility allows firms in different regions to use their services successfully. GoCardless offers a 90-day free trial for businesses. This trial period lets people try the service before buying. It’s an opportunity to determine if GoCardless suits your payment collecting needs.

Final Words

GoCardless is, in my opinion and based on my own experiences, a reliable payment gateway that makes the process of collecting payments simple and streamlined for companies of any size. It really shines for companies that need to collect regular payments, which makes it a fantastic alternative for enterprises that are subscription-based or membership-based.

The Good and Bad

GoCardless provides its users with a number of useful features, including the capacity to handle foreign payments in a seamless manner, automatic payment collection, adjustable payment schedules, and payment tracking.

The Good

- Clear and straightforward pricing structure.

- Supports various currencies, facilitating international transactions.

- Offers a 90-day free trial for users to evaluate the service.

- Offers both Standard and Advanced plans to cater to different business needs.

The Bad

- Transaction fees are percentage-based, which might not be the most cost-effective for high-value transactions.

- Extra charges apply for certain types of transactions, such as UK Bank Debit payments exceeding £2,000.

Questions and Answers

GoCardless is flexible and can help businesses of all sizes and types, but it works best for subscription services, SaaS companies, and nonprofits that use recurring billing methods.

GoCardless uses security measures that are standard in the business and follows data protection rules. This makes it safe to handle payments and customer data.

One problem with GoCardless is that it only works with regular payments. This means that it might not be the best choice for businesses that need to accept different types of payments. Also, based on where you live, it might not accept credit card payments.