Table of Contents

Goodbudget and Mint are two of the most popular personal finance management applications that are aimed to assist individuals in regaining control of their financial situations. In order to help you make an educated decision, we’ll compare the most important features, price structures, usability, and more. A user-friendly envelope budgeting system that encourages disciplined spending is one of the features offered by Goodbudget.com.

On the other hand, Mint is superior when it comes to the automated tracking of expenses and account aggregation. This post will throw light on which of these tools corresponds better with your financial objectives and lifestyle. Whether you’re a budgeting aficionado or simply searching for an easier way to manage your costs, this article will help you determine which of these tools is best for you.

Goodbudget vs Mint Comparison Table

Goodbudget and Mint are both apps for planning. Goodbudget focuses on envelope budgeting, which is great for people who want strict control over how much they spend in each category. Mint makes it easy to keep track of expenses and get a full picture of your finances without having to do much.

| Feature | Goodbudget | Mint |

|---|---|---|

| Budgeting Method | Envelope Budgeting | Automated Budgeting |

| Expense Tracking | Manual Entry | Automatic Transaction Imports |

| Mobile Apps | Yes, iOS and Android | Yes, iOS and Android |

| Account Linking | No | Yes |

| Financial Insights | Basic | Comprehensive |

| Debt Tracking | No | Yes |

| Bill Payment Reminders | No | Yes |

| Investment Tracking | No | Yes |

| Cost | Free and Paid Plans | Free |

| Download Now | Download Now |

Goodbudget vs Mint: User Interface and Ease of Use

Mint’s design is known for its modern look and feel, which makes it easy on the eyes and simple to use. Mint stands out because it has so many ways to change things. Users can customize their financial dashboard to put the information and details that are most important to them at the top. This level of customization lets you get a customized view of your finances, which makes it easier to keep track of costs, keep an eye on investments, and pay bills in an efficient way.

Goodbudget is easy to use, but Mint’s sleek design and personalized dashboard give users more control over how their financial information is shown. This makes Mint the best choice for people who want a budgeting experience that is both visually appealing and adjustable. Which one you choose comes down to how important looks and flexibility are to you in a budgeting tool.

Goodbudget vs Mint: Budgeting and Expense Tracking

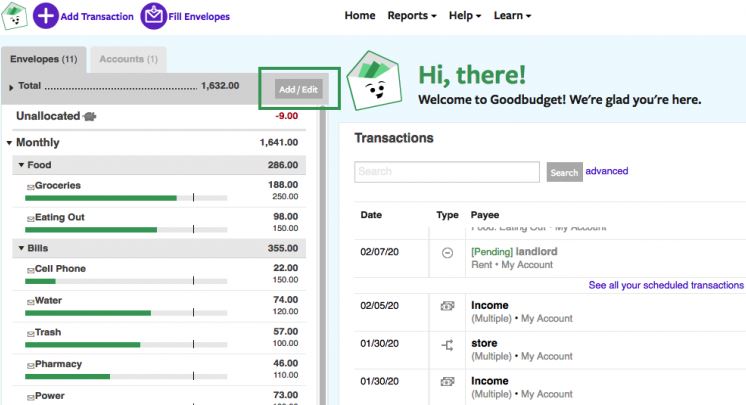

Goodbudget and Mint have different ways of planning. Goodbudget uses a method called “envelope budgeting,” in which users put money into different categories, or “envelopes.” This hands-on method gives you a lot of control and discipline, so it’s perfect for people who want to keep a close eye on their money and spend it on what’s most important to them.

Mint, on the other hand, organizes transactions instantly into categories based on how they are spent. It makes it easier and more automated to keep track of your spending and learn about your funds. Mint’s ease of use is especially appealing to people who like to budget with less effort and who like automation.

Goodbudget vs Mint: Security and Data Privacy

Both Goodbudget and Mint place a premium on maintaining the confidentiality of their customers’ personal and financial information. They use encryption protocols to protect the data both while it is being transmitted and while it is being stored. In addition, user accounts are given an additional layer of defense in the form of two-factor authentication, which is supported by both of the aforementioned platforms.

Their privacy policies prioritize being open and honest with customers. Users are able to learn how their data is handled and secured by reviewing the privacy policies that are specific to their unique services. Because of this dedication to transparency, users are able to have faith in the procedures followed by the platforms to protect their data.

Goodbudget vs Mint: Customer Support

When compared to Goodbudget, the customer assistance solutions provided by Mint are significantly more comprehensive. Users of Mint have access to a chat support option in addition to the various support channels available to them. This real-time chat support can be very beneficial when it comes to addressing pressing difficulties and getting prompt responses to enquiries.

On the other hand, Goodbudget’s customer service is mostly carried out through the medium of electronic mail (email assistance). Email support may still be useful, but it does not typically provide the same level of immediate assistance that chat support does.

On the other hand, both platforms supplement their customer assistance with extensive knowledge bases that include frequently asked questions (FAQs), tutorials, and guidelines. Users are given the ability to independently troubleshoot common issues and improve their understanding of the apps through the usage of these tools.

Goodbudget vs Mint: User Reviews and Ratings

Goodbudget has been praised for its user-friendliness and its adherence to the envelope budgeting system, in which users assign a certain amount of money to a particular category. On the other hand, because to the necessity of manually entering transactions, which can be a time-consuming process, some users feel it to be less user-friendly than Mint.

On the other hand, praise is heaped upon Mint for the way it automatically tracks transactions and allows users to customize their budget categories. It provides both ease of use and in-depth financial insights. However, users have experienced sporadic difficulties in synchronizing their bank accounts, which can have an impact on the reliability of the data.

Goodbudget vs Mint: Integration with Banks and Financial Institutions

The procedure of combining several types of financial accounts, such as checking, savings, credit cards, and loans, is made easier by the fact that Mint integrates with a wider variety of banks than its competitors do. This strong connectivity makes it easier for users to keep track of their transactions and provides them with a detailed summary of their current financial situation.

One of the most noteworthy benefits of using Mint is the ability to manage one’s credit score, which gives users the ability to monitor the state of their credit over time. Individuals who are interested in enhancing their creditworthiness may find this to be of tremendous assistance.

In addition, unlike Goodbudget, Mint allows you to keep track of your investments through an automatic process. Users are provided with a comprehensive view of their financial situation as a result of this functionality, which enables them to manage their investment portfolios, track performance, and evaluate their financial goals.

Goodbudget vs Mint: Mobile App Features

Both Goodbudget and Mint allow users to better manage their finances while they are on the go by providing mobile apps that are compatible with both the Android and iOS platforms. Nevertheless, the functionality of mobile apps varies significantly from one another.

The mobile app for Mint differentiates out from the competition because to its automatic transaction syncing, which makes it easier to keep tabs on one’s expenditures and revenues. By providing customers with real-time updates on their financial transactions and balances, this feature contributes to a more streamlined and accurate experience when it comes to budgeting their money. In addition, Mint provides a holistic view of one’s financial situation by providing insights into account balances, bills, and spending habits, all of which are easily available via the mobile app.

Which is better?

Whether you should use Goodbudget or Mint relies on how you manage your money. With its envelope-based method, Goodbudget is a great choice if you like to be in charge of your budget and stick to it. It is especially helpful for people who want to take an active role in handling their money. On the other hand, Mint is great at automating things in an easy way, which makes it a top choice for people who want an easy way to track costs and combine accounts. At the end of the day, the choice comes down to what you prefer: manual budgeting with Goodbudget or automatic budgeting with Mint.

Goodbudget: The good and The bad

Goodbudget is a modern way to keep track of your budget. Don’t carry any more paper packages. This tool helps you stay on track with your family budget.

The Good

- User-friendly interface.

- High-level security for financial data.

The Bad

- Limited customer support options.

Mint: The good and The bad

You can manage almost every facet of your personal finances with the assistance of Mint, from your income and expenses to your credit score.

The Good

- Automated expense tracking simplifies financial management.

- Free to use.

The Bad

- Some users may have security concerns.

Questions and Answers

Goodbudget is likely to be fun for you if you like reports and graphs. Its reports show you how you’re spending your money and how close you are to reaching your goals. The reviews can also help keep people on track to reach their goals.

plans that cost money. Goodbudget has two plans: one that is free and one that costs $7 per month or $60 per year. Here are some of the other biggest differences: Keeping track of money.