Table of Contents

The days of toiling away at laborious manual financial procedures are quickly becoming a thing of the past in this day and age, when COVID-19 is in effect and the field of digital transformation is continually expanding. In this rapidly changing digital landscape, the role that AP automation plays is becoming an increasingly vital one. Keeping track of accounts payable can be a challenging task, particularly for companies that are undergoing rapid expansion or teams who are dealing with a steady influx of vendor transactions and invoices.

The development of automation software has, thankfully, made it possible to streamline the labor-intensive, paper-based components of account payable management in a way that is both efficient and effective. You have arrived at the right location if you are now on the path of looking for the best possible solution to automate your AP processes.

In this in-depth analysis, I will draw from my own experiences in order to provide a comprehensive comparison of the eight most popular accounting process automation technologies. I’ll go over the advantages and disadvantages of each of these potential solutions in detail so that you can make an informed decision about which one to go with. By the time you reach the conclusion of this article, you will be better ready to assess which automation solution for AP best corresponds with the specific requirements that your team has set for itself. Let’s not waste any more time and immediately set out on this adventure of discovery.

What is Accounts Payable Automation Software?

In most cases, accounts payable automation software is a single component of a more comprehensive accounting software package. Other elements that can be included in accounting systems are tools for managing accounts receivable, functions for processing invoices, a comprehensive list of accounts, and procurement services.

On the other hand, some of the AP automation solutions can function independently. In these kinds of situations, you might need to look into integrations that provide the possibility of linking the accounts payable software to the accounting or bookkeeping program of your choice. Verify that the stand-alone AP automation software you choose offers a private, compliant, and secure solution before making your purchase.

Knowing where your AP data is saved, how it is utilised, and how you may access it from anywhere is the most crucial thing to know because there is such a vast range of options available to choose from.

Best Accounts Payable Automation Software Comparison Table

It is essential to have accounts payable software in order to pay your vendors and suppliers in a smooth and organized manner. Your company will be able to concentrate on maximizing the value it derives from its partnerships with a wide variety of other companies if it has timely paid its debts and invoices. The market, on the other hand, is awash with a wide variety of accounts payable systems, some of which include software for paying suppliers and vendors.

| Feature | Type | Key features | Pricing | Integrations | Target users | Website Link |

|---|---|---|---|---|---|---|

| Centime | Spend management | Real-time spend visibility, budgeting, forecasting | Subscription-based, pricing varies depending on features and usage | Integrates with a variety of ERP and accounting systems, including SAP | Small and medium-sized businesses (SMBs) with global operations | Visit Website |

| Tipalti | Payables automation | Global payment processing, tax compliance | Subscription-based, pricing varies depending on features and usage | Integrates with a variety of ERP and accounting systems, as well as HR and travel management systems | SMBs to large enterprises | Visit Website |

| QuickBooks Online | Accounting software | Accounting, invoicing, bill pay, payroll | Subscription-based, pricing varies depending on features and usage | Integrates with a variety of ERP and accounting systems, as well as payment processing and e-commerce platforms | SMBs to large enterprises | Visit Website |

| Kissflow Procurement Cloud | Procurement software | Purchase requisitions, approvals, purchase orders | Subscription-based, pricing varies depending on features and usage | Integrates with a variety of ERP and accounting systems, as well as e-sourcing and supplier relationship management (SRM) systems | SMBs to large enterprises | Visit Website |

| DocuWare | Document management software | Document capture, workflow automation, electronic signatures | Subscription-based, pricing varies depending on features and usage | Integrates with a variety of ERP and accounting systems, as well as other document management and workflow automation solutions | SMBs to large enterprises | Visit Website |

Best Accounts Payable Automation Software

The word “accounts payable” (AP) refers to the short-term debts that a corporation owes to its creditors or suppliers. In most cases, these are invoices for products or services that the company has obtained but has not yet paid for. AP is categorised as a liability on the company’s balance sheet and is normally settled within thirty to sixty days after the due date.

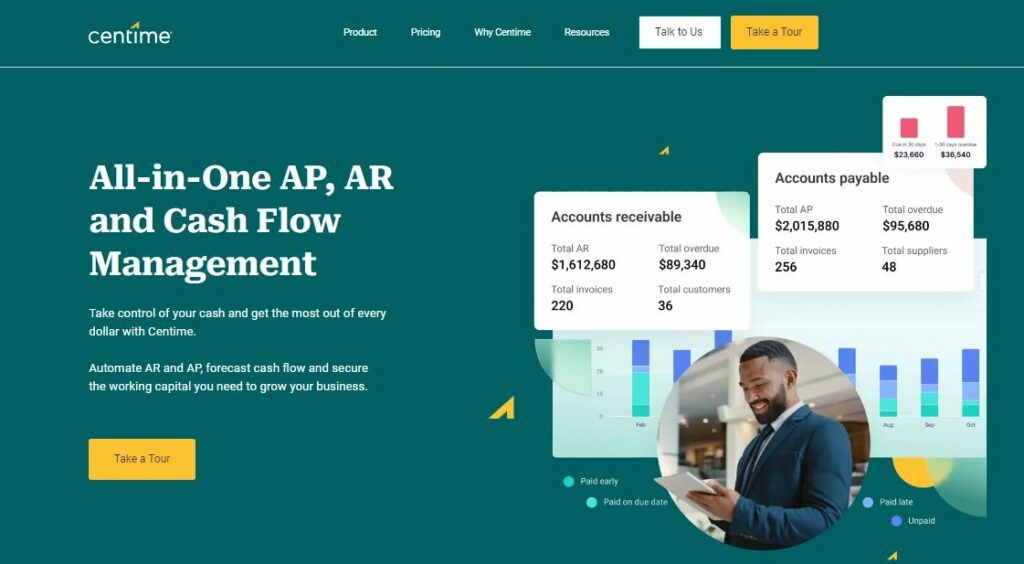

Centime

| Feature | Description |

|---|---|

| Automated Invoicing | Streamlines invoicing processes. |

| Expense Tracking | Helps in monitoring and managing business expenses. |

| Payment Management | Facilitates efficient payment handling. |

My experience with e-commerce has been much improved because to Centime. The way that companies like mine optimise their online sales has been completely transformed as a result of this cutting-edge technology. It provides customers with a hassle-free purchasing experience while also providing merchants with powerful tools to efficiently manage their business operations.

My experience has shown me that the most amazing aspect is the way it simplifies payment procedures, while ensuring safe and trouble-free transactions, both of which have been essential to the success of my company.

The Good

- User-friendly interface

- Efficient invoice management

- Comprehensive expense tracking

The Bad

- Limited customization options

- Integration with other software can be improved

Tipalti

| Feature | Description |

|---|---|

| Global Payments | Enables secure international payment transactions. |

| Compliance Tools | Assists in adhering to regulatory and tax norms. |

| Supplier Onboarding | Streamlines supplier enrollment processes. |

My company could not have survived financially without the assistance of Tipalti. It goes above and beyond to simplify global payables and automate a variety of financial procedures, which positions it as a leading solution in the field of financial technology.

Because of my own experiences, I can attest to the fact that Tipalti not only ensures compliance but also significantly cuts down on the number of payment errors that occur and, most importantly, improves the workflows that are involved in our accounts payable processes. Any company that is serious about improving their financial management should absolutely consider investing in this.

The Good

- Robust compliance features

- Simplified global payments

- Smooth supplier onboarding

The Bad

- Complex initial setup

- Customer support can be slow at times

QuickBooks Online

| Feature | Description |

|---|---|

| Accounting | Comprehensive accounting tools and reports. |

| Invoicing | Simplifies invoicing processes for businesses. |

| Expense Tracking | Tracks and categorizes expenses efficiently. |

As the owner of a small business, I’ve found that utilising QuickBooks Online has been quite helpful in better managing my company’s finances. I’ve been using it for some time now. This widely used accounting software provides an intuitive user interface in addition to a profusion of features that are tailored to meet the specific requirements of micro, small, and medium-sized enterprises.

QuickBooks Online has helped me tremendously in streamlining my financial management by providing me with hassle-free invoicing, assistance in monitoring my expenditures, and the ability to generate analytical financial reports.

The Good

- Wide range of accounting features

- User-friendly interface

- Integration with various apps

The Bad

- Limited user permissions

- Customization options are somewhat restricted

Kissflow Procurement Cloud

| Feature | Description |

|---|---|

| Procurement Tools | Aids in managing procurement processes. |

| Vendor Management | Streamlines vendor communication and handling. |

| Purchase Orders | Simplifies creation and tracking of orders. |

The procurement and supply chain management procedures have been significantly improved as a direct result of our implementation of Kissflow Procurement Cloud. This all-encompassing software not only improves our organization’s productivity but also fosters greater collaboration and transparency among its employees.

Because of my own experiences, I can attest to the fact that it automates workflows in a fluid manner, which in turn enables us to develop stronger ties with our vendors. Any company that is serious about bringing their purchasing practices into the 21st century has to have this technology.

The Good

- Intuitive user interface

- Efficient procurement management

- Effective vendor handling

The Bad

- Reporting features could be more advanced

- Learning curve for new users

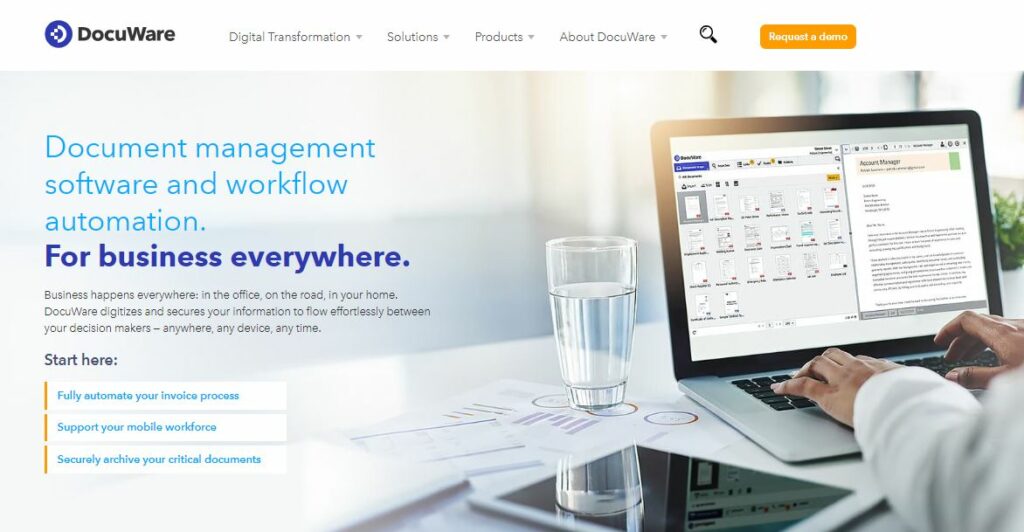

DocuWare

| Feature | Description |

|---|---|

| Document Storage | Securely stores and organizes business documents. |

| Workflow Automation | Automates document-based processes. |

| Collaboration | Facilitates team collaboration on documents. |

When it comes to the automation of workflows and the management of documents, DocuWare has been a revelation. Our methods for managing documents have been much simplified as a result of using this system, and it is now a breeze to digitise and arrange our data.

In my opinion, the system does an excellent job of preserving documents in a speedy and safe manner, retrieving documents in a timely manner, and encouraging communication inside our organisation. Because it has allowed us to reduce the amount of time spent on various tasks while simultaneously increasing our total productivity, it is a great asset for any company.

The Good

- Robust document management

- Automated workflows

- Easy collaboration features

The Bad

- Initial setup can be time-consuming

- Limited mobile app functionality

Benefits of Using Accounts Payable Automation Software

Businesses that are wanting to increase their efficiency and optimise their financial procedures can reap a number of benefits by implementing accounts payable (AP) automation software. The following is a list of the primary benefits that come with utilising AP automation software:

- Savings in Both Time and Money: Automation of accounts payable cuts down greatly on the amount of time and effort needed for human data entry, processing of invoices, and payment approvals. As a result, labour expenses are reduced, and the processing of transactions is sped up.

- Reduced Occurrence of Error: Automation helps to reduce the number of human errors that might occur as a result of manual data entry. These errors can include data inconsistencies, duplicate invoices, and incorrect payments. This improves both the accuracy of the data and compliance with the financial regulations.

- Optimisation of the Invoicing Workflow: The entire process of invoice approval can be streamlined by using AP automation software, which makes it simpler for staff members to evaluate, approve, and manage invoices in a manner that is both uniform and efficient.

- Expediting the Processing of Invoices: Automated processing of bills speeds up the flow of invoices from the point of receipt to the point of approval, which ensures that payments are processed in a timely manner. This may result in early payment discounts as well as improved relationships with the vendors.

- Increased Transparency and Reporting Capabilities: Automation of accounts payable gives organisations real-time visibility into their financial data, which enables them to monitor the status of their invoices, examine their payment history, and generate thorough reports for use in analysis and decision-making.

- Relations with Vendors Have Been Improved: Payments that are made promptly and accurately strengthen relationships with vendors and may result in improved payment terms, discounts, and a higher level of confidence between an organization and its suppliers.

How to Choose the Right Accounts Payable Automation Software

For companies that are interested in streamlining their financial procedures, selecting the appropriate accounts payable (AP) automation software is an essential decision that must be made. The following is a list of procedures that will assist you in selecting the most appropriate AP automation software for your organization:

- Determine Your Requirements and Objectives: To get started, you need to have a solid awareness of the precise AP needs and goals of your organization. Think about things like the number of users, the volume of invoices, the needs for integration, and the desired level of automation before making your decision.

- Establishing Your Financial Plan: Create a spending plan for the accounts payable automation program. Once you have a better understanding of the financial limits you face, your selections will become more manageable.

- Evaluate the Reputation of the Vendor: Conduct research on and evaluations of the vendors of AP automation software to determine their track records and reputations. If you want to determine how satisfied users are and how reliable a vendor is, you should look for reviews, case studies, and client testimonials.

- Ability to scale up: Make sure that the software you choose can keep up with the expansion of your company. It should be able to accommodate growing amounts of invoices as well as expanding business requirements.

- Interface That Is Friendly to Users: Choose software that has an interface that is easy to understand and navigate. Adoption and day-to-day usage are both made easier for your team by having a UI that has been thoughtfully built.

- Integration Capabilities: Check to see if the accounts payable automation software can be effectively integrated with your other financial systems, such as accounting software and enterprise resource planning systems. Integration reduces the amount of time spent entering data and ensures that data is consistent.

Questions and Answers

Automation of the accounts payable process is a strategy for reducing the amount of human participation in the process of accounts payable, also known as trade payables, as well as removing jobs that are prone to error. This is accomplished through the utilisation of accounts payable software that has been incorporated with an internet business network that digitally connects trading partners.

Not only will accounts payable automation liberate teams from monotonous, time-consuming, manual chores, but it will also lower the risk of fraud within an organisation by providing additional insights and oversights at every stage of the accounts payable workflow.