Table of Contents

Near Field Communication, or NFC, is an interesting technology that has changed a lot in the last few years, making it easier to use our gadgets. In the beginning, NFC was mostly linked to smart cards, paper ads, and commuter cards. On the other hand, I can say from personal experience that adding it to Android, iOS, and Windows phones has dramatically changed things.

The NFC app for Android has become an important part of my life, and it’s not just for making mobile payments easier. There are a lot of options for expert users to look into, even though Google Pay is still a popular choice. Personally, I’ve learned how useful NFC tags are because they make it easy to automate many phone tasks. It’s more than just making deals easier, as most people think.

For example, I’ve found it very helpful to use NFC tags to share information easily, open certain apps with a single touch, and even set up wireless settings right away. You can make your phone even more useful for me by adding this level of customization. It shows how NFC technology, which used to only be used in certain situations, has grown into an important part of making the whole mobile experience better. From its original uses to these more personalized and streamlined ones, NFC has shown how flexible and useful it can be in our daily lives.

Best NFC Payment Apps

An NFC-enabled reader is a component of NFC payment apps. This reader assists in the transmission of a signal that identifies the payment device that is compatible with NFC. In the event that a consumer begins a payment, the enabled reader is able to obtain the payment information from the payment device or smartphone.

| Feature | Google Pay | Apple Pay | Samsung Pay | PayPal | Android Pay (now Google Pay) |

|---|---|---|---|---|---|

| Platform | Android devices | iOS devices | Samsung devices | Cross-platform | Android devices |

| Biometric Authentication | Yes (device-dependent) | Yes (Face ID, Touch ID) | Yes (device-dependent) | Yes (device-dependent) | Yes (device-dependent) |

| Loyalty Cards Support | Limited | Limited | Limited | No | Limited |

| Wearable Compatibility | Limited | Apple Watch | Samsung Gear, Galaxy Watch | Limited | Limited |

| Website Integration | Google Pay API | Apple Pay API | Samsung Pay SDK | PayPal API | Google Pay API |

| Security | Tokenization, PIN, Biometrics | Tokenization, Face ID, Touch ID | Tokenization, PIN, Biometrics | Encryption, Buyer Protection | Tokenization, PIN, Biometrics |

| International Availability | Limited | Widely available | Limited | Widely available | Limited (rebranded as Google Pay) |

| Supported Banks/Cards | Varied | Varied | Varied | Varied | Varied |

Best NFC Payment Apps

The proliferation of NFC payment apps over the years has resulted in an increase in the number of clients who are interested in using these applications. Therefore, let’s talk about these applications and the ways in which they are integrated with a variety of features in order to make them more user-friendly for clients.

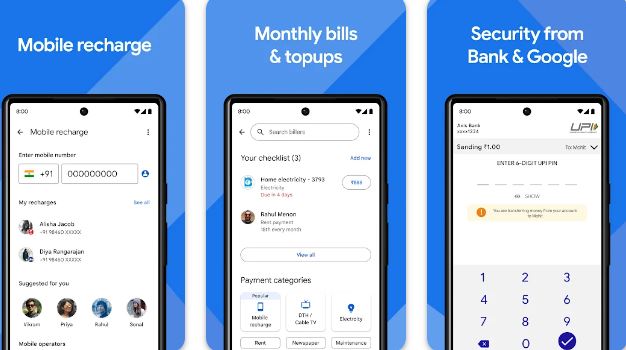

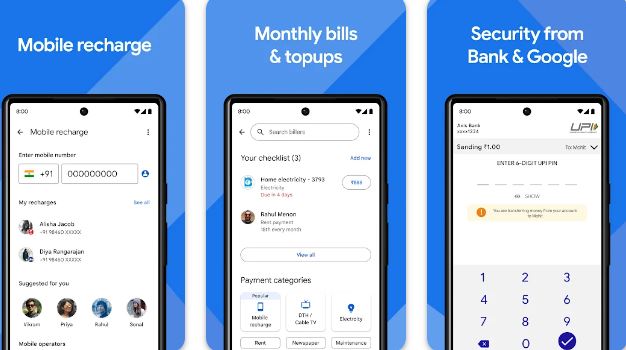

Google Pay

| Feature | Description |

|---|---|

| Payment Options | Supports various payment methods, including cards and UPI |

| Integration | Seamlessly integrates with Google services and apps |

| Security | Offers robust security measures for safe transactions |

| Loyalty Programs | Allows users to earn and redeem rewards |

| Peer-to-Peer Payments | Facilitates easy money transfers between users |

| Google Play Store |

When it comes to technology, Google Pay is my first choice. As an Android user, it has really changed how I pay for things. My phone is now my one-stop shop for all things related to payments because it can easily connect to my debit and credit cards, reward program, and even boarding passes. Everything is so much easier to get to now that I can just tap my phone.

This is especially true now that contactless payment terminals and online shops accept them so widely. Google Pay isn’t just a way for me to pay; it’s an important and useful tool in my daily life.

The Good

- Wide range of supported payment methods

- Integration with Google ecosystem

- Strong security features

- Loyalty program benefits

- Convenient peer-to-peer payments

The Bad

- Limited merchant acceptance in some regions

- Requires a compatible device and operating system

Apple Pay

| Feature | Description |

|---|---|

| Contactless Payments | Enables secure and quick contactless transactions |

| Apple Wallet | Stores boarding passes, tickets, and loyalty cards |

| Face ID/Touch ID | Biometric authentication for added security |

| Apple Cash | Allows peer-to-peer money transfers within iMessage |

| Apple Card Integration | Seamless integration with the Apple Card |

Google Pay is my first choice when it comes to tech. The way I pay for things has changed a lot since I got an Android phone. Because it’s so easy to connect, my phone can now handle all of my payments. It can connect to my debit and credit cards, reward schemes, and even boarding passes. I can get to everything so much faster now that I can just tap my phone.

It’s even more important now that so many stores and payment systems accept contactless cards. Google Pay is more than just a way for me to pay. It’s an important part of my daily life.

The Good

- Secure and convenient contactless payments

- Integration with Apple Wallet for added functionality

- Biometric authentication enhances security

- Peer-to-peer money transfers with Apple Cash

- Apple Card integration for a comprehensive financial experience

The Bad

- Limited to Apple devices and ecosystem

- Limited merchant acceptance compared to traditional cards

Samsung Pay

| Feature | Description |

|---|---|

| MST Technology | Magnetic Secure Transmission for wider acceptance |

| Samsung Rewards | Earn points for transactions, redeemable for rewards |

| Secure Element | Enhanced security through a dedicated chip |

| Loyalty Programs | Participate in exclusive promotions and discounts |

| Integration | Works with Samsung devices and some non-Samsung devices |

I was surprised by how far Samsung Pay has come since it was only available on Samsung phones. It works best on Galaxy phones, but it can now also be used on other Android phones. The special magnetic secure transmission (MST) technology makes it stand out.

It lets you pay at terminals that don’t allow contactless payments. With this new feature, Samsung Pay is clearly better than some competitors, and I always use it, no matter what device I’m on.

The Good

- MST technology for wider merchant acceptance

- Samsung Rewards for earning and redeeming points

- Enhanced security with a dedicated chip

- Exclusive promotions and discounts through loyalty programs

- Compatibility with both Samsung and some non-Samsung devices

The Bad

- Limited acceptance in regions without MST support

- Requires a compatible device

PayPal

| Feature | Description |

|---|---|

| Online Payments | Facilitates secure online transactions globally |

| Buyer Protection | Offers protection for eligible purchases |

| One Touch | Enables quicker checkouts with a single touch |

| Mobile App | Manage transactions and account on the go |

| Send Money | Easily send money to friends and family |

People all over the world know PayPal for online transactions, and I’ve had a great time using its mobile wallet tool. Linking my bank accounts, credit cards, and store rewards program gives me more power and flexibility over my money than ever before.

PayPal is usually used for online transactions, but the fact that it can also be used to pay in stores (using QR codes or integrating with Google Pay or Samsung Pay) makes shopping even easier for me.

The Good

- Global acceptance for online transactions

- Buyer protection for eligible purchases

- Quick and convenient checkouts with One Touch

- Mobile app for managing transactions on the go

- Easy money transfers to friends and family

The Bad

- Transaction fees for certain transactions

- Limited acceptance in physical stores compared to other services

Android Pay

| Feature | Description |

|---|---|

| Contactless Payments | Quick and secure contactless transactions |

| Loyalty Programs | Integration with loyalty programs for added benefits |

| In-App Payments | Seamless payments within supported apps |

| Multiple Card Support | Add and use multiple cards for flexibility |

| Google Wallet Integration | Access to Google Wallet features and services |

While Android Pay has been taken off the market, don’t worry—its spirit lives on in the new Google Pay. As an Android user, the fact that Android Pay’s features have been seamlessly added to Google Pay has made my payment experience even smoother. Not only does this unified method make sure that my transactions are smooth, but it also covers all of my financial dealings in the digital world.

The Good

- Quick and secure contactless payments

- Integration with various loyalty programs

- Seamless payments within supported apps

- Flexibility with multiple card support

- Access to Google Wallet features and services

The Bad

- Limited merchant acceptance compared to major competitors

- Requires a compatible device and operating system

What are NFC Payment Apps?

Payment apps that use Near Field Communication (NFC) technology to make mobile payments safe and easy are called NFC payment apps. NFC is a type of short-range wireless connection that lets devices that are close together—usually within a few centimeters—share information. This technology is used by NFC payment apps to make deals possible between a phone and a point-of-sale (POS) terminal or another device that works with NFC.

- Compatibility with Devices: For the transaction to go through, both the mobile device and the payment terminal or item that is being paid for must have NFC capabilities. Most smartphones today have NFC technology built in.

- Installing an app: People need to put an NFC payment app on their phones in order to use it. Most of the time, banks, other banking institutions, or third-party payment service providers offer these apps. Some examples are banking apps and mobile cash apps like Apple Pay, Google Pay, and Samsung Pay.

- Adding Payment Methods Together: People connect the NFC payment app to the payment method they prefer. In this case, “payment sources” can be credit or debit cards, bank accounts, or other digital ones.

- Steps taken for safety: NFC payment apps have safety features that keep user data and financial data safe. Some of these steps are encryption, tokenization, biometric identity (like recognising a fingerprint or face), and security features that are unique to each device.

- Starting to make payments: People who want to buy something open the NFC payment app on their phone, choose a payment method, and then bring their phone close to a POS device that supports NFC. Using NFC technology, the two devices talk to each other.

- Confirmation of Transaction: The user may have to enter a PIN, use biometric identification, or follow the security steps set up by the NFC payment app to confirm the transaction. This step makes sure that payments can only be made by people who are allowed to.

- How to Send Data:The payment information is sent safely from the mobile device to the POS terminal through the NFC connection once the user accepts the transaction.

- Authorization for Payment: The point-of-sale (POS) device handles the payment request and talks to the right financial networks or banks to confirm the transaction. As long as the payment goes through, the deal is done.

Questions and Answers

As a top Android NFC payment app, it enables users to make purchases within the app as well as payments at physical stores. Android Pay is the greatest payment app for Android, and it is even compatible with point-of-sale terminals and vending machines.

How to Pick the Right NFC Chip: The chip you pick should meet your goals. Type 2 tags, like the NXP NTAG 213, are popular and not too expensive. The NTAG 215 is great for storing more URL characters. The NTAG 216 is a great choice for digital business cards in the UK because it can store 888 bytes.