Table of Contents

Over the years, I’ve had the opportunity to use a variety of different apps for personal finance, and I can tell that many of them focus on certain financial chores, such as helping you save money, earn high-interest rates, handle bills, or even get incentives for your spending. I can say this because I’ve had the opportunity to use these apps myself. Finding a single platform that integrates banking and investment accounts can be quite a problem. However, there are certain platforms that offer this combination.

My previous interactions with Albert are relevant in this regard. When it comes to the management of my finances, having Albert as a partner has been a game-changer for me. Not only can I save and invest money with the help of this software, but I can also get sound advice regarding my financial situation all in one convenient location. It is exactly the same as having a personal financial counselor available to you at any time.

One of the most notable qualities of Albert is its capacity to facilitate the streamlining of a variety of different financial chores, potentially at no additional expense. This application offers a comprehensive solution to assist you in regaining control of your financial situation and making more informed choices regarding your money. You may put money down for the future, increase the value of your investments, or just get a better handle on your day-to-day finances with the help of Albert. He has you covered in all three areas.

Albert Specifications

Even though Albert is still in the process of being developed, it has already learned to execute a wide variety of activities, including the ones described above. It is a potent instrument that may be put to use for a number of tasks, including writing, translation, research, and programming, among others.

| Feature | Specification |

|---|---|

| Model type | Transformer-based language model |

| Parameters | 18B |

| Layers | 12 |

| Heads | 12 |

| Hidden size | 768 |

| Attention size | 768 |

| Training dataset | A massive dataset of text and code, including books, articles, code repositories, and other public sources. |

| Training objectives | Multiple language modeling and code generation objectives. |

| Visit Website |

What Is Albert?

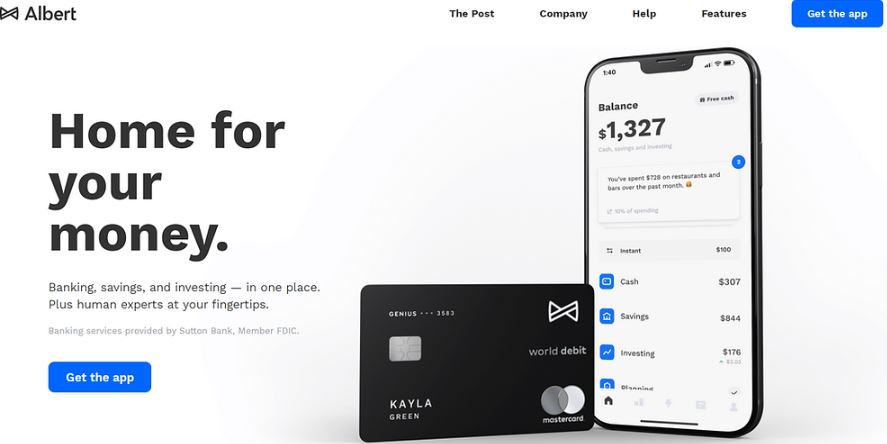

The financial monitoring program known as Albert does it all, including automating saves, managing budgets, and creating individualized investment portfolios, among other things. It is intended to meet all of your month-to-month financial requirements in a single convenient location. Users are able to save money, spend money, borrow money, and invest using the Albert app.

Here’s what the Albert app can do at a glance:

- Keeps track of account assets and net worth

- It saves you money by keeping track of what you spend and setting money away for you when you can afford it.

- Offers fee-free ways to get cash

- Allows you to get your pay two days early

- sets up a personalized collection of investments

- Gives discounts and insurance choices

Albert review: Smart Savings

The Genius membership tier is required to access the Smart Savings feature of Albert. This function does an analysis of the user’s income, expenses, and spending patterns in an effort to assist them in reducing their financial burdens. You are able to set precise goals for your savings using Smart Savings, such as putting money away for a car or creating an emergency fund.

After then, it will put money aside on a weekly basis in order to assist users in achieving their objectives. Do you prefer to make the transfer of funds into your savings account on your own? It’s not an issue; you can turn off Smart Savings whenever you choose.

Albert review: Investing

Through its mobile application, Albert, which is a FINRA-accredited broker dealer and an SEC-registered investment advisor, gives users access to various investing services. Users of Albert Genius will be able to begin constructing their portfolios with as little as one dollar, and there are no trading costs associated with using the platform.

They have the option of purchasing individual stocks, traditional portfolios, or themed investments. You have the option of giving Genius permission to tailor-make investment accounts for you based on the objectives you have set for your finances. All that is required of you is to provide responses to a few questions regarding your investing objectives, level of comfort with risk, and available time period.

The investment option caters specifically to first-timers and those with less experience in the financial markets. They will be able to learn the ropes and create money over time with the assistance of the Albert savings app. In addition, an auto-invest option is accessible to Genius members, which will assist them in maintaining their consistent investment strategy.

Albert review: Cash advances

One of the most well-liked aspects of Albert is the fact that it offers rapid cash advances. The app provides you with a cash advance of up to $250, free of charge and without interest, to help carry you over until your next payday. There is also no demand for a credit check, and there are no late fees or overdraft fees associated with Albert Cash. On the other hand, Instant could assess fees for overdrafts.

Albert review: Financial

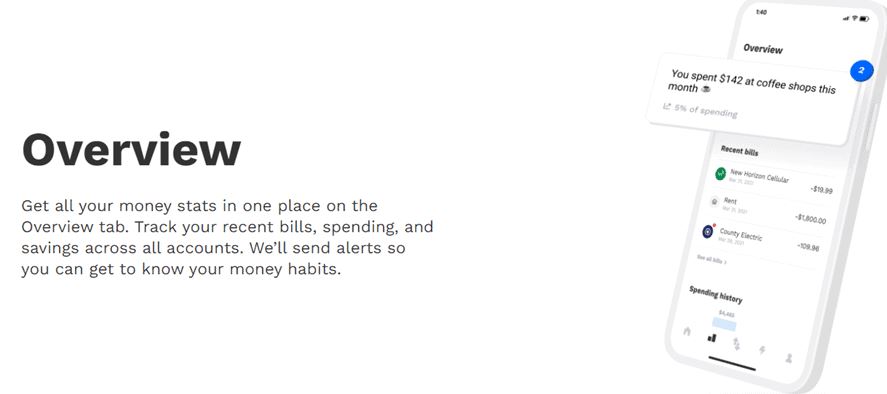

On the home screen of the Albert app, you will find a summary of how your finances are now standing. In addition, you will be able to monitor previous expenditures, upcoming invoices, and the amount of money that has been saved. The expenses are even put into the appropriate categories on their own, just as you would get with a budgeting program such as Mint or YNAB.

The most beneficial aspect of Albert’s summary, on the other hand, is that it notifies the user of unexpected transactions, spikes in bills, and overdraft fees. In addition to this, it may search for unused subscriptions and find them for you, much like the service that Truebill does. In addition to this, the application collaborates with Billshark, a bill negotiating tool that you may utilize to potentially reduce monthly expenses such as your phone plan, cable television, and internet service.

Final Words

From my own experience, I know that the Albert app can be a good choice for handling money and investing. The main reason it’s one of the most famous cash advance apps is that it doesn’t charge fees or check your credit.

Because of my own financial needs, I tend to choose specific apps and services over solutions that do everything. This means that I will use apps like Mint to make a budget and a TD brokerage account to manage my assets. But I know that some people like having a financial answer that takes care of everything, and that’s exactly what Albert wants to offer.

It’s important to remember that if you want to pay the $6 a month for the Genius feature, you should make sure you’ll actually use all of the app’s features. However, if you need help with saving and spending, Albert is definitely someone you should talk to.

Albert review: The Good and Bad

It would appear that Albert App can handle everything. It can help you set up a custom investment portfolio, manage your budget, automate your saves, and manage your financial planning, among other things.

The Good

- The number of free and premium savings tools

- Spending and investment accounts in the same app

- Financial experts provide personalized advice

The Bad

- Monthly fee charged for some key features

- No phone support

Questions and Answers

It is essential to bear in mind that Albert does not save your banking credentials, and they employ security on the same level as a bank to protect your information. As a result, as a member of Albert, you can rest easy knowing that all of your bank accounts are being handled properly.

You are allowed to borrow up to $250 dollars from Albert. When it comes to cash advances with Albert Instant, there are no credit checks performed. This sum is determined by a multitude of factors, one of which being the amount of money that you make.