Table of Contents

My experience have shown that navigating the world of personal finance applications may be extremely intimidating; nevertheless, it is also extremely vital for me to do so in order to maintain control of my financial wellness. Because of this, I have discovered that Mobills is an exceptional option.

Allow me to walk you through a comprehensive evaluation of Mobills, showcasing its numerous features, user-friendly design, powerful security measures, various price options, and other aspects. This ought to provided you with a comprehensive overview, allowing you to make an educated conclusion regarding whether or not Mobills is the appropriate solution for your requirements in terms of financial management.

Features Table

Here is a short list of Mobills’ most important features that show what makes it different from other personal budget apps.

| Feature | Description |

|---|---|

| Budgeting Tools ???? | Create custom budgets, set spending limits, and track progress. |

| Expense Tracking ???? | Easily record income and expenses, categorize transactions. |

| Bill Tracking & Reminders ⏰ | Manage bills, set due dates, and receive timely reminders. |

| Financial Reports & Insights ???? | Gain valuable insights into your spending habits through graphs and charts. |

| Goal Setting ???? | Set financial goals and track progress towards achieving them. |

| Security ???? | Secure login with data encryption. |

| Visit website |

What is Mobills App?

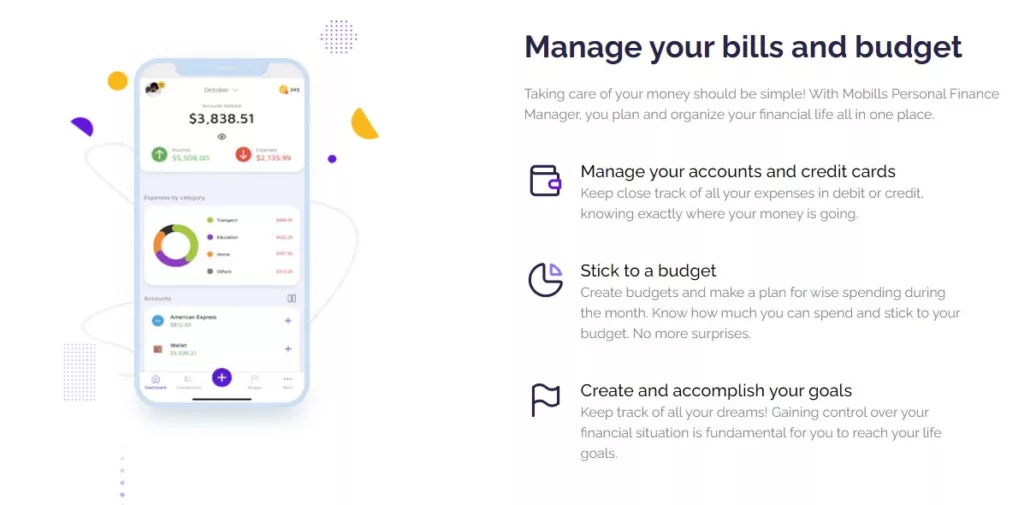

Both on my phone and on the web, Mobills have a big part of my life. With the help of this great programme for handling personal finances, I can keep a tight grip on my money situation. When you use Mobills, it will be easier to keep track of your income, spending, budgets, and financial goals. The app has a lot of tools that make managing your money easier and help you get ahead financially overall.

User Experience and Interface

The designed to be easy for anyone to use, so it’s simple to find your way around the app. In my opinion, this is one of the best reasons to choose it. The clean style and well-organized layout are especially helpful for me because they make it easy to get to all of my important financial information, like trades, budgets, and goals.

Because of the seamless experience provided by the mobile app, I am able to effortlessly manage my funds regardless of where I am. What a wonderful feeling it is to have a personal finance assistant right in my pocket!

Budgeting Tools and Strategies

They give me strong budgeting tools that let me make and change budgets based on my needs and goals with money. It doesn’t just make budgets; it also sorts costs into a lot of different groups. I can keep track of the money I spend on things like food, bills, fun things to do, and more. It is important to be able to see where your money is going, and this level of order helps me do that.

Bills also lets me keep track of my budget, so I can see how much I spent versus how much I had planned to spend. With this real-time tracking, I can stay on track with my money goals and see where I may be spending too much or need to change how my budget is set up.

Expense Tracking and Management

With it , it’s easy to keep track of how much you spend. From what I’ve seen, the app have many features that make it easy for me to keep track of my spending. One example is that it’s easy for me to put my spending into categories that make sense for my spending habits, like groceries, bills, activities, and so on. This area helps me make better budgets because it shows me exactly where my money is going.

One more good thing about it is that it lets me add notes and receipts to the costs I’ve paid. This level of attention to detail has helped me keep track of why I’ve spent money on each thing, which is especially helpful for business or tax reasons. With this and its help, I can also keep a thorough record of all of my financial transactions.

Bill Tracking and Payment Reminders

My experience with Mobills has shown that it makes it easier for me to keep track of my bills by enabling me to set up individualised payment schedules and sending me notifications about scheduled payments.

I am able to avoid incurring late fees and ensure that all of my invoices are accounted for and paid on time thanks to this service, which allows me to receive reminders at the specific moment they are due. My procedure of managing my bills has been simplified as a result of this functionality, which has made it much simpler for me to maintain my organisation and be careful with my finances.

Insights and Analysis in Mobills

Mobills go beyond only keeping track of my expenses by providing me with comprehensive analysis of my information regarding my finances. My ability to recognise patterns of expenditure, trends, and areas in which I might improve my financial habits is facilitated by this practice.

The software offers detailed reports and visualisations that are simple to comprehend, which enables me to make decisions regarding my finances that are based on accurate information. Mobills gives me the tools I need to efficiently manage my finances, whether I want to keep track of my monthly spending, determine areas in which I can make reductions, or evaluate my overall financial health.

Goal Setting and Achievement

It is possible for me to establish a variety of financial objectives with it, including goals for saving money, milestones for reducing my debt, and investing objectives. My progress towards these objectives is then monitored by the application, which provides me with updates and insights as I move along.

A quality that stands out is its capacity to provide motivational insights, which enables me to maintain my concentration and keep me encouraged during my journey towards financial independence. As I work towards accomplishing my financial goals, I will find that the mix of goal-setting, measuring my progress, and receiving feedback to motivate me can be of tremendous assistance to me.

Security and Privacy Measures

It is very important to us that everyone is safe and sound. There are extra steps we’ve taken to make sure your information is kept safe. Cryptography is a set of very complicated rules used to protect private data like financial activities and personal details. To make sure you are who you say you are and to keep other people from getting into your account without your permission, we have also set up safe ways to authenticate you.

Along with that, we have also taken a number of different steps to protect our info and stay safe from any threats. Industry standards say that you need to do regular security checks and keep a close eye out for behaviour that could be linked to possible threats. Even though you are in charge of your money, we will always put your safety first and give you the peace of mind you need.

Pricing Plans and Options

The free version of Mobills was a great way for me to start planning and keeping track of my spending without having to pay anything. It had basic features like putting costs into groups, making budgets, and making simple reports.

As I learned more about handling my money, I chose one of its ‘ more advanced plans. I could make as many budgets as I wanted, create my own categories, use advanced reporting and analysis tools, connect these plans to my other financial accounts, and get priority customer help. The cost of the subscription changed based on the plan and payment cycle (monthly or yearly), so I could pick the one that worked best for my budget and needs.

Final Words

I think Mobills is a great way to keep track of my personal funds. It has many useful features that have made it easier for me to make budgets, keep track of my spending, handle my bills, and set goals. It’s easy to get around thanks to the user-friendly design, and the insightful analysis has helped me make better financial decisions. I also feel safe about my data because of the strong security steps. I would suggest it to anyone who wants to improve their financial health.

If you enjoyed reading this and think your friends and family could benefit from it, please feel free to share it on Facebook and Twitter. By giving to others, you raise the probability that others will also find value in what you have to offer.

The Good and The Bad

Having an understanding of Mobills’s advantages and disadvantages will help you make decisions when you are investigating the platform. The following is an outline of the aspects of Mobills that are amazing as well as the areas in which it might be improved.

The Good

- Intuitive interface for easy navigation.

- Comprehensive budgeting tools and customization options.

- Timely bill reminders and payment tracking.

- Insightful analysis and goal tracking features.

The Bad

- Some advanced features limited to premium plans.

- Occasional syncing issues reported by users.

Questions and Answers

Certainly, Mobills provides mobile applications for mobile devices running iOS and Android, in addition to a web-based platform for PC users.

The answer is yes; Mobills gives users the ability to synchronise their bank accounts in order to automatically import and track transactions.

To answer any questions or address any concerns that users may have, Mobills does, in fact, offer customer assistance through email and integrated in-app help tools.