Table of Contents

From my own experience, budgeting apps are now important to keep track of your money in this busy world. There are so many apps out there that it can be hard to choose the best one for your needs. You will learned everything you need to know about the five great planning apps in this guide. They are Honeydue, GoodBudget, EveryDollar, and Wally. You can easily keep track of your spending, set and meet your financial goals, and make smart choices about your money with each of these apps.

This app stands out because of its envelope planning method. People can put money into different boxes and keep track of how much they spend in each one. EveryDollar, on the other hand, makes sure that every dollar is used for what it was meant to do by using a zero-based planning method. Wally likes to keep things simple and easy to use, which makes it easy to keep track of your money and spending.

Simple is more than just a planner because it has banking features like saving with goals in mind and keeping track of your spending automatically. This app is for couples and lets them manage their money, set goals, and see how much they’ve spent.

Best Budget Apps Comparison Table

When it comes to managing personal finances, I’ve find that planning apps are essential for people and families like ours. These apps let us keep track of our spending, make budgets, keep an eye on our savings goals, and learn more about how we handle our money. There are so many planning apps out there that it can be hard to pick the right one for your needs and financial goals.

| Feature | GoodBudget | EveryDollar | Wally | Simple | Honeydue |

|---|---|---|---|---|---|

| Pricing | ???? Free/Premium | ???? Free/Premium | ???? Free | ???? Free | ???? Free |

| Budgeting Tools | ???? Envelope System | ???? Zero-Based Budgeting | ???? Expense Tracking | ???? Goal Setting | ???? Shared Expenses |

| Platform | ???? Android, iOS, Web | ???? Android, iOS, Web | ???? Android, iOS | ???? Android, iOS | ???? Android, iOS |

| User-Friendly | ✨ Intuitive Interface | ✨ Simple Navigation | ✨ Easy to Use | ✨ Minimalistic Design | ✨ User-Friendly |

| Expense Tracking | ???? Detailed Reports | ???? Transaction History | ???? Spending Insights | ???? Transaction Insights | ???? Shared Spending |

| Integration | ???? Bank Account Sync | ???? Bank Sync | ???? Manual Entry | ???? Bank Connection | ???? Partner Integration |

| Community Support | ???? User Forums | ???? Online Community | ???? Support Channels | ???? Community Resources | ???? Help Cent |

Best Budget Apps

Thanks to planning apps, keeping track of your money have become easier and faster in this digital age. There are many tools in these apps that can help you keep track of your spending, set financial goals, and get a better handle on your money. I’ll talk about some of the best low-cost apps in this detailed guide. Each one has its own strengths and weaknesses. No matter how much you know about money or how new you are to planning, these apps can help you do it better, smarter, and easier.

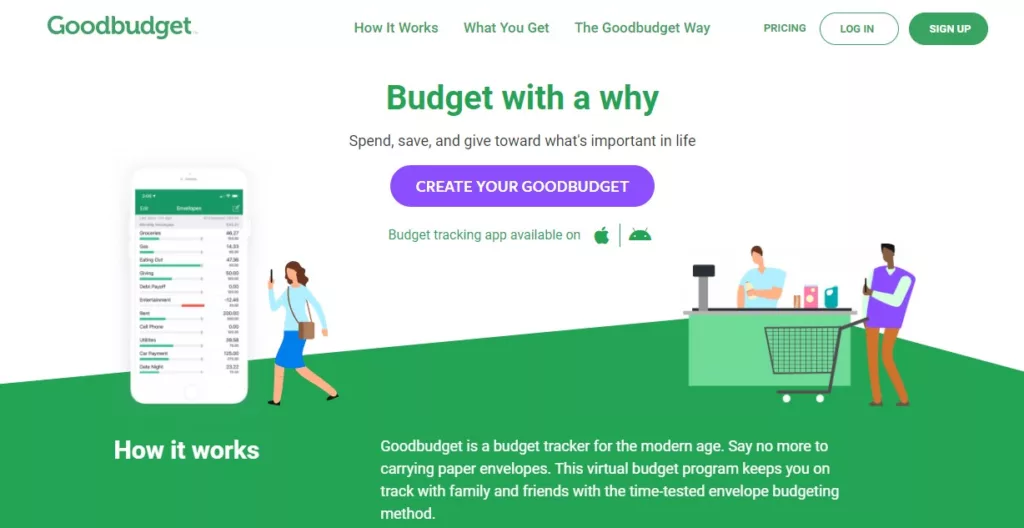

GoodBudget

| Feature | Description |

|---|---|

| Budget Envelopes | Allocate money into specific categories or envelopes |

| Expense Tracking | Track spending and monitor budget progress |

| Shared Budgets | Collaborate on budgets with family or housemates |

| Debt Payoff Tracker | Monitor and manage debt repayment progress |

| Sync Across Devices | Access budget data on multiple devices |

| Visit website |

Because of its efficient envelope budgeting system, GoodBudget have become my go-to budgeting tool of choice this year. Through the use of this method, I divide my money into virtual envelopes and allot them to other categories of spending, such as grocery, entertainment, and utilities.

I am able to more easily keep track of where my money is going thanks to the visual representation of my budget. Syncing across numerous devices, tracking expenses, and providing analytical insights are all features that further enhance my experience with GoodBudget when it comes to budgeting.

The Good

- Envelope-based budgeting system

- Shared budgets for collaboration

- Debt payoff tracking

- Available on multiple devices

- Free version available

The Bad

- Limited features in the free version

- Interface may not be as modern or intuitive as some other apps

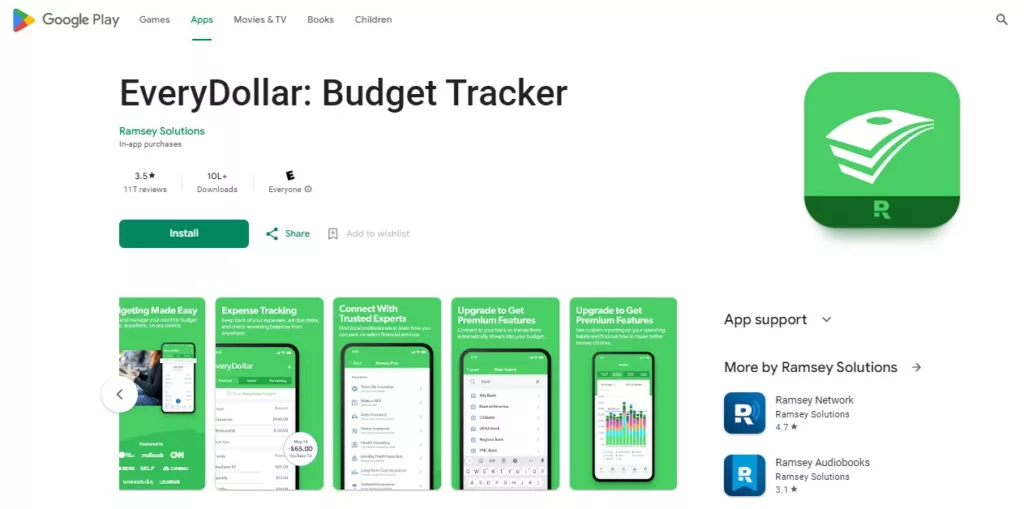

EveryDollar

| Feature | Description |

|---|---|

| Zero-Based Budgeting | Allocate every dollar to a specific budget category |

| Expense Tracking | Track spending and stay within budget limits |

| Customizable Budgets | Create budgets tailored to your financial goals |

| Monthly Reporting | Review spending and budget performance monthly |

| Debt Snowball Tracker | Track progress on debt payoff using the snowball method |

EveryDollar, which was made by personal finance expert Dave Ramsey, is one of the best choices for people who want to use zero-based budgeting. This way of thinking sets aside a certain amount of money for each day, like paying bills, saving for emergencies, or wasting money on things that aren’t necessary.

The app has helped me prioritise my spending and work towards my general financial goals by automatically syncing my transactions, keeping track of my spending against my budget, and giving me information about my financial progress.

The Good

- Zero-based budgeting approach

- Customizable budget categories

- Debt snowball tracker

- Monthly reporting and insights

The Bad

- No free version; subscription required for full access

- Limited integration with financial institutions

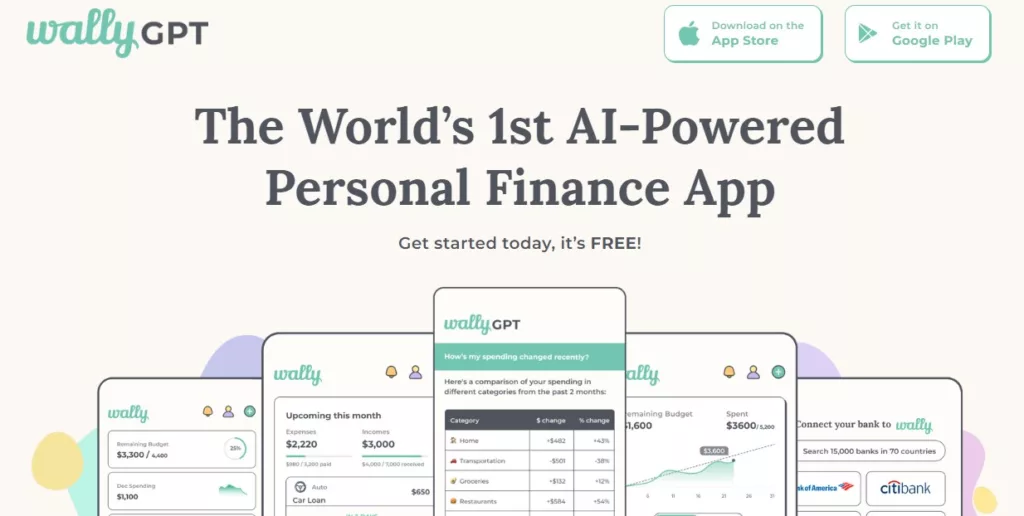

Wally

| Feature | Description |

|---|---|

| Expense Tracking | Log and categorize expenses for better budgeting |

| Budget Goals | Set spending goals and track progress |

| Currency Conversion | Convert expenses and income into different currencies |

| Receipt Scanning | Scan and store receipts for easy expense tracking |

| Insights and Trends | Visualize spending patterns and trends |

Another thing that interests me about Wally is how easy it is to use for planning. It helps me keep track of my spending, sets savings goals for me, and shows me how my money flows.

Keeping track of budgets is now a lot easier thanks to new features like being able to scan receipts, change countries for trips abroad, and share budgets with families or couples. It’s easy for people of all skill levels to use because the interface is clean and simple. This makes planning a fun and enjoyable experience.

The Good

- Expense tracking and budget goals

- Currency conversion for international users

- Receipt scanning feature

- Insights and trends analysis

- Free to use

The Bad

- Limited budgeting features compared to some other apps

- Less robust customer support compared to premium apps

Simple

| Feature | Description |

|---|---|

| Safe-to-Spend | Account balance minus upcoming bills and savings goals |

| Expense Tracking | Categorize and track expenses for budgeting |

| Savings Goals | Set and track progress towards financial goals |

| Instant Transfers | Transfer money instantly between Simple accounts |

| Visa Debit Card | Use a Simple Visa debit card for everyday purchases |

One of the most notable features of Simple is that it is an all-in-one solution that combines budgeting and banking completely. Not only does it offer powerful budgeting tools, but it also offers fee-free banking, options for goal setting, automated savings transfers, and real-time transaction tracking,

all of which are significant features. My financial objectives are well-aligned with the app’s mission to make banking easier and to encourage the development of sound financial habits.

The Good

- Safe-to-Spend feature for smarter spending decisions

- Expense tracking and categorization

- Savings goals and progress tracking

- Instant transfers between Simple accounts

- Visa debit card with no fees

The Bad

- Limited to users in the United States

- Not as feature-rich as some other banking apps

Honeydue

| Feature | Description |

|---|---|

| Joint Accounts | Manage finances together with a partner |

| Bill Reminders | Receive reminders for upcoming bills and payments |

| Expense Tracking | Track spending and categorize transactions |

| Chat Messaging | Communicate with your partner about finances |

| Account Aggregation | View multiple accounts in one place for easier tracking |

Honeydue has an invaluable resource for the couple in terms of managing their finances. It allows for the monitoring of joint accounts, the establishment of spending limitations, and the provision of notifications regarding forthcoming bills.

My partnership has become more financially transparent and harmonious as a result of the app’s features, which include the ability to categorise expenses, bill reminders, and secure communication within the app itself. When it comes to establishing financial unity with my partner, the collaborative approach to budgeting that Honeydue provides has proven to be really helpful.

The Good

- Joint accounts for managing finances with a partner

- Bill reminders and payment tracking

- Expense categorization and tracking

- Chat messaging for financial discussions

The Bad

- Limited functionality compared to individual budgeting apps

- Some users may prefer more customization options

Features to Look for in Budget Apps

There are a lot of budgeting apps out there, but I need to make sure that the one I choose fits my spending goals and how I live. There are some important things to look for in budget apps that will help me plan better, teach me more about money, and give me the power to choose wisely with my money. When I’m making a budget, these tools are very helpful because they help me keep track of my spending, set saves goals, and watch my investments.

- Make sure that the application can be synchronised without any problems across all of your devices so that you can easily access it and receive updates in real time.

- Expense Tracking, When looking for expense tracking tools, you should look for powerful systems that can classify your spending, monitor patterns, and provide insights into your usual financial routines.

- Methods of Budgeting,Take into consideration the techniques of budgeting that are utilised by the application, such as the envelope approach, zero-based budgeting, or customisable budgeting alternatives.

- Setting Goals, Determine whether or not the application is able to help users create savings goals, monitor their progress, and provide concrete actions to reach their financial milestones.

- When it comes to protecting your financial information, you should give priority to applications that have robust security measures, such as encryption, two-factor authentication, and data protection methods.

- If you want your budgeting experience to be as smooth as possible, you should select an application that has a user interface that is both user-friendly and intuitive.

Questions and answers

In order to safeguard users’ financial information, the majority of budgeting apps place a high priority on user security and make use of encryption and other security measures. Nevertheless, it is of the utmost importance to select trustworthy applications that come equipped with robust security features and to keep your login credentials safe.

To answer your question, yes, budgeting applications may assist you in saving money by allowing you to keep track of your expenses, establish savings goals, and gain insights into your spending habits. They promote responsible expenditure and the optimisation of financial resources.

A great number of budgeting applications have various features that enable couples or families to manage their finances jointly. These features include joint account tracking, spending sharing, and tools for budget cooperation.