Table of Contents

Your capacity to maintain your current level of financial stability is directly influenced by the budgeting software that you use. EveryDollar and Monarch stand out as formidable competitors in this industry, with each offering a distinct set of benefits. This conclusion is based on my own personal experiences. In this comparison, I will analyze EveryDollar and Monarch in great detail, breaking down their respective strong points and weak points so that you are better equipped to make an informed decision that is in line with both your financial goals and your lifestyle.

This study will guide you to the budgeting solution that best meets your criteria, regardless of whether the ease of use, the ability to budget, the ability to track expenses, or the accessibility through mobile device is most important to you. EveryDollar and Monarch are going to accompany us on this adventure into the world of managing personal finances, so let’s get started!

Everydollar vs Monarch Comparison Table

EveryDollar and Monarch are important for making a good budget. EveryDollar is great at making budgets easy to use, while Monarch is great at keeping track of expenses and giving you insights.

| Aspect | EveryDollar | Monarch |

|---|---|---|

| Pricing | $0 (Free) or $129.99/year | Starting from $9.99/month |

| User Interface | User-friendly, simple design | Modern, intuitive interface |

| Budgeting Features | Goal-based budgeting | Advanced financial analysis |

| Expense Tracking | Yes | Yes |

| Mobile App Availability | iOS and Android | iOS only |

| Integration Options | Limited | Various financial platforms |

| Customer Support | Email support | Email and chat support |

| visit website | visit website |

Everydollar vs Monarch: User Experience and Interface

EveryDollar is quite user-friendly, in my opinion, which is one of the many reasons why I use it. It has a straightforward layout that is easy to understand, which makes navigating the site quite simple and eliminates any extra complexities.

On the other hand, Monarch likewise provides a user-friendly interface, but it differentiates itself from other options by having a contemporary and aesthetically appealing design. Users that place a high value on having a polished appearance may find that its streamlined style is particularly appealing.

Everydollar vs Monarch: Budgeting Capabilities

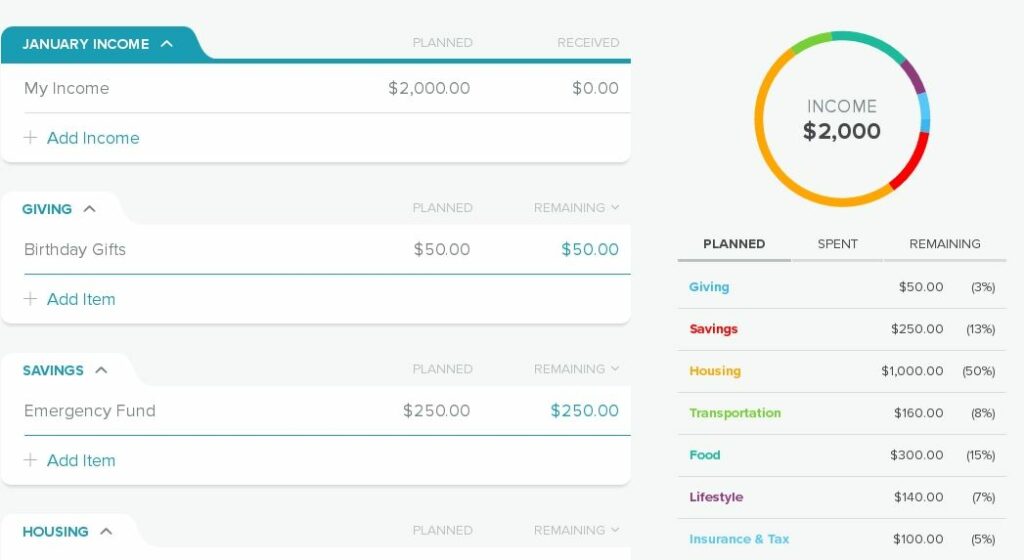

EveryDollar uses the well-known zero-based budgeting strategy popularized by Dave Ramsey. This is based on my own personal experience with the method. It ensures that users’ budgeting processes are comprehensive by guiding them through the process of allocating every dollar of their revenue to particular budget categories.

In contrast, Monarch provides users with adaptable budgeting capabilities that enable them to modify their budgets to the specific financial goals they have set for themselves. It allows for a degree of flexibility in budgeting procedures, making it possible to accommodate various financial strategies.

Everydollar vs Monarch: Expense Tracking and Reporting

When it comes to maintaining a record of one’s financial obligations, I have found that EveryDollar excels above the rest. Because it has a feature that links transactions, it is relatively simple to record expenses and organize them in an effective manner. For users who require more comprehensive financial analysis, it is important to keep in mind that the reporting tools provided by EveryDollar may be considered fairly simplistic.

On the other hand, Monarch is exceptional in its ability to track expenses as well, as it offers a wide variety of powerful capabilities. Its capacity to give in-depth analysis of your spending patterns is what sets it different from other products on the market. Users who seek in-depth financial analysis and detailed reporting may use Monarch because it provides more extensive reporting choices than its competitors.

Everydollar vs Monarch: Mobile App Accessibility

Based on my own research and observations, I’ve discovered that both EveryDollar and Monarch provide users with user-friendly mobile applications that are compatible with iOS and Android. Users, such as me, are able to simply manage their budgets while moving about thanks to these apps. The intuitive organization of EveryDollar’s web interface is mirrored in the app’s design, which is a nice feature because it makes the app easy to use.

In a similar vein, Monarch provides users with a mobile app that improves the overall quality of their experience. Users are able to easily monitor their financial situation from any location thanks to the adaptable features and modern style of this app. In the course of my personal efforts to better manage my finances, I have found that this flexibility is quite helpful.

Everydollar vs Monarch: Integrations and Compatibility

EveryDollar’s interfaces with financial institutions make it possible for users to benefit from the time-saving feature of automatic transaction imports. It is important to note, however, that in comparison to other budgeting programs, it may have a more limited number of integrations available to choose from.

On the other side, Monarch has been amazing with the rapidly growing range of integrations that it offers. Because of its adaptability, it is simple to establish connections with a diverse range of bank accounts and services. This wide adaptability has been demonstrated to be a considerable advantage, since it adapts very well to a variety of different financial conditions.

Which is better?

EveryDollar or Monarch is better depends on your specific budgeting needs. EveryDollar, created by Dave Ramsey, offers a user-friendly interface and is ideal for individuals looking for simple, goal-based budgeting. Monarch, on the other hand, offers more advanced features and is suitable for those who want in-depth financial analysis and forecasting. Consider your budgeting goals and preferences when choosing between the two.

Everydollar: The good and The bad

EveryDollar is an online zero-dollar budgeting tool developed by Ramsey Solutions. It operates in a manner that is analogous to that of YNAB.

The Good

- Simple and easy-to-use for beginners.

- Offers a free version.

The Bad

- Limited integration options.

Monarch: The good and The bad

The television show Monarch is a mix between a murder mystery and a drama centered on country music.

The Good

- Provides advanced financial analysis.

- Offers compatibility with various financial platforms.

The Bad

- Paid subscription required.

Questiosn and Answers

Monarch Money has a great group of founders and writers, and user safety is also a top priority. One of the most important things they do to keep your money safe is use data that can only be read. That means that Monarch Money can keep an eye on your investments and see how you spend your money.

Monarch is a great way to keep track of how you spend your money and where it goes if you want a good spending tool. You can keep track of your transactions, put them into groups, make your own groups, and even add tags for other people in your home.