Table of Contents

YNAB (You Need A Budget) and Simplifi are excellent mobile applications for managing personal finances; I can say this with confidence after having experience with both of them. They will each assist you in regaining command of your financial situation in their own special way. YNAB differentiates out from other budgeting software thanks to its zero-based budgeting approach, which challenges users to find a purpose for each and every dollar they spend.

On the other hand, the budgeting experience provided by Simplifi is one that is both more straightforward and more streamlined. In this essay, I will share some personal insights with you and evaluate these two platforms based on the features they offer, the pricing they provide, and how user-friendly they are in order to assist you in selecting the one that best meets your requirements for your finances.

YNAB vs Simplifi Comparison Table

Whether you should use YNAB or Simplifi relies on how you budget. YNAB is great for manual planning with a learning curve, while Simplifi makes tracking easy and does it for you. The most important thing is to find a tool that fits your needs, whether you want a lot of power (YNAB) or a simpler, automatic method (Simplifi).

| Specification | YNAB | Simplifi |

|---|---|---|

| Budgeting Method | Zero-Based Budgeting | Simplified Budgeting |

| Expense Tracking | Manual Input | Automatic Tracking |

| Pricing | Subscription-based | Subscription-based |

| Goal Tracking | Yes | Yes |

| Reporting and Analytics | Comprehensive Reports | Basic Analytics |

| Mobile Apps | iOS, Android | iOS, Android |

| Integration | Bank and Financial Apps | Bank and Financial Apps |

| Security | High | High |

| User Interface (UI) | Learning Curve | User-Friendly |

| Download Now | Download Now |

What is YNAB?

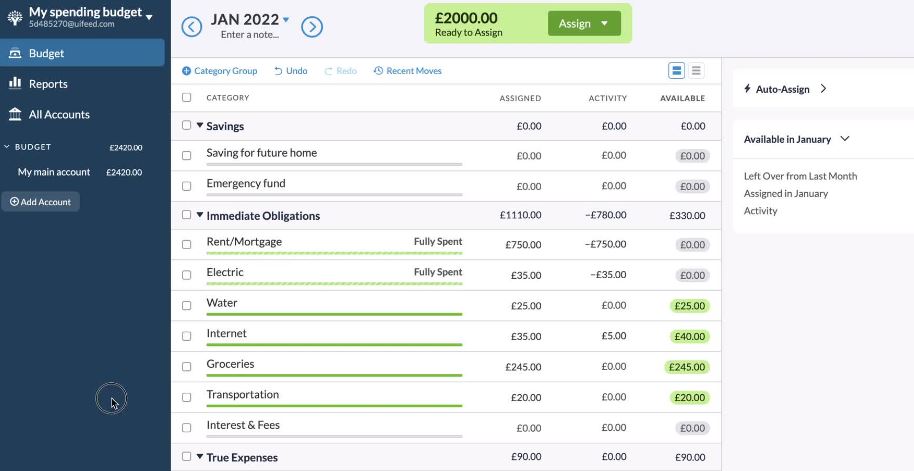

I’ve been using You Need a Budget (YNAB) for a while now, and it has really changed the way I handle my money. YNAB is more than just another planning app; it’s a lifeline for your money. The unique thing about it is that it uses a new method called “zero-based budgeting.” With YNAB, I give each dollar I earn a specific goal, which has totally changed the way I manage my money.

Using YNAB has been like having a trusty financial advisor in my pocket, at least in my case. It has helped me divide my income into different groups so I can see exactly where my money is going. This method has forced me to decide how I want to spend my money and cut out costs I don’t need. This has led to more financial stability and peace of mind.

What is Simplifi?

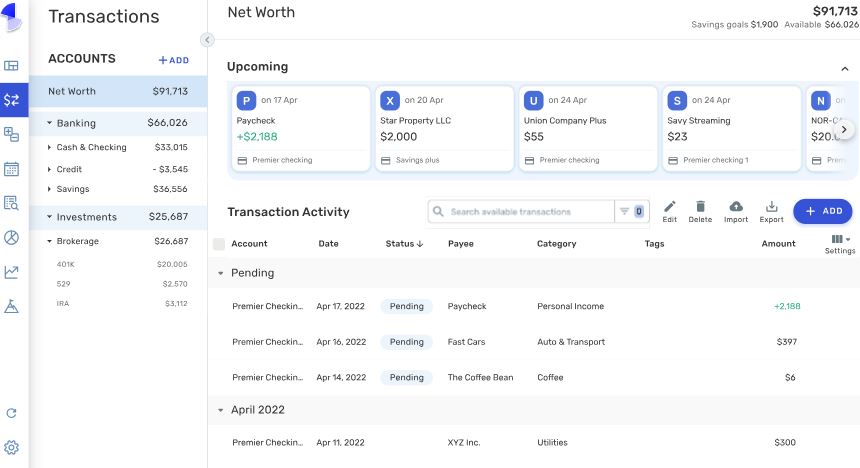

Simplifi is a financial management app made by Quicken, which is a well-known and trusted name in the world of personal finance software. From my own experience, Simplifi stands out because it makes the sometimes scary job of managing your finances very easy.

One of the best things about Simplifi is how easy it is to use. I liked how straightforward it was. It doesn’t have complicated choices or jargon that are hard to understand. Instead, it has a clean, well-organized platform that makes it easy to use and understand, even for someone like me who isn’t a financial expert.

Budgeting Methodology in YNAB

I’ve discovered that using YNAB’s zero-based budgeting method gives you the ability to genuinely take charge of your own finances. It is essential to put each and every dollar you earn to good use, whether it be for paying off debt, putting money away for a specific occasion, or simply for day-to-day expenses. This strategy has assisted me in proactively planning my financial matters and preventing myself from going into debt by preventing me from incurring excessive costs. It’s almost like having a financial road plan to follow, which helps me make informed choices about my money.

Budgeting Methodology in Simplifi

Simplifi has shown itself to be a trustworthy and easy-to-use planning tool. It takes a simple approach to managing your money and gives you a full picture of your financial state without requiring you to put every dollar in a specific category. This method makes sense to people like me who like a budgeting style that is more open and can be changed as needed.

Simplifi is great at making it easy to track income and spending, which makes it easy to keep track of money transactions. Its easy-to-use layout and graphical representation of financial data make it easy to see where your money is coming from and going. This has been very helpful in helping me figure out how I spend my money and where I can make changes.

YNAB vs Simplifi: Savings and Goal Tracking

I’ve used both YNAB and Simplifi, so I can say that they both have a great trait in common: they both let you set, track, and manage your savings goals. This feature has been a real game-changer in my financial life, making it easy and precise for me to reach different financial goals.

YNAB and Simplifi are great at helping you reach your goals, whether it’s building up an emergency fund to give you peace of mind, saving hard for that dream trip you’ve always wanted, or planning carefully for big expenses like a home renovation or a new car.

YNAB vs Simplifi: Reporting and Analytics

Both YNAB and Simplifi understand the significance of providing users with access to reporting and analytics tools, which can provide users with useful insights into the ways in which they manage their finances. Individuals who want to take control of their financial situation, make decisions based on accurate information, and eventually accomplish their financial goals should have these tools at their disposal.

Users of each program can generate detailed reports that provide a holistic perspective of their current financial condition using the other application. These reports often include information about income, expenses, savings, and debt, among other financial matters. Users are able to monitor their spending over time, giving them the ability to recognize recurring tendencies and patterns in their personal finance habits. This can be of tremendous assistance in identifying areas in which they may be spending more than they should or places in which they can reduce their spending and save more money.

Which is better?

You should use YNAB. The zero-based budgeting method used by YNAB urges you to give every dollar a specific job. This can be very empowering for people who want to take full control of their finances. It’s like having a financial manager in your pocket, helping you organize your spending and plan for the future.

On the other hand, Simplifi might be a better choice if you want to make planning easier and keep track of your spending automatically. The easy-to-use design of Simplifi makes it easy to keep an eye on your finances without having to worry about every single dollar. It’s a great choice for people who want a full picture of their finances but don’t want to worry about putting every dollar into a different category.

YNAB: The good and The bad

YNAB review to determine whether or not this budgeting application meets your specific requirements about your finances. Learn about the various features, how easy it is to use, and whether or not it is worth it.

The Good

- Effective zero-based budgeting system

- Detailed expense tracking

The Bad

- Learning curve for beginners

Simplifi: The good and The bad

Simplifi is a money tracking tool developed by Quicken that allows you to view all of your financial accounts, including bank, loan, investment, and other accounts, in a single location.

The Good

- Simplified budgeting experience

- Automatic expense tracking

The Bad

- Limited analytics and reporting

Questions and Answers

Simplifi by Quicken is a great budgeting tool if you want to make a thorough plan for how much you spend and save each month and don’t mind paying for a subscription.

It’s also a way of life because you have to be responsible about budgeting. You’ll find a job for every dollar and make changes as needed between paychecks or other money coming in. When you first start using YNAB, there is a bit of a learning curve, but it is well worth it to keep going.