Table of Contents

Unlocking the full potential of Experian Boost has changed the way I improve my credit score. This free service goes above and beyond the usual ways of doing things because it adds good information to my credit report and fills in any gaps that may exist. But it’s important to keep in mind that Experian credit scores are only one part of the bigger picture of credit scoring. It occurred to me as I learned more about credit scores that different models, like FICO and VantageScore, add to the bigger picture of money. What makes them different is the way they weigh the factors that affect credit scores. This means that even for the same person, their scores can be different.

I’ve learned that checking my credit scores from all three major credit bureaus is the only way to really get a sense of how creditworthy I am. With this all-around look, I have a better idea of my overall financial situation. Like many other people, I get a free credit report every year from each bureau. This keeps me informed about the health of my credit.

Taking care of my credit score has become second nature to me, and I’ve started doing a few things to make sure it keeps going up. Some of the most important things I do to manage my money are pay my bills on time, keep my credit balances low, and avoid opening new credit accounts that I don’t need. These steps, along with Experian Boost’s power, have not only raised my credit score but also given me a sense of being in charge of my money.

Experian Specification

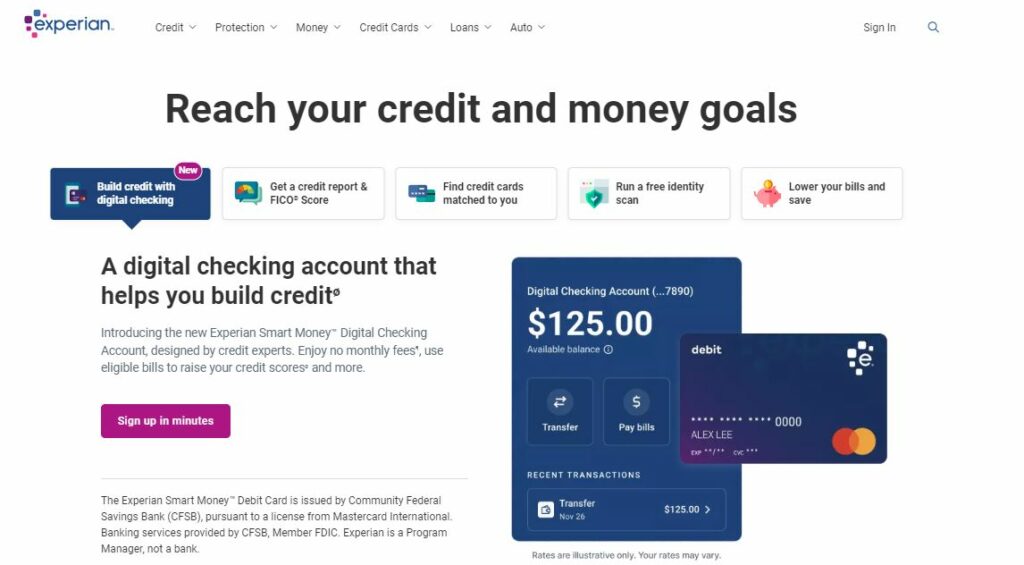

Along with Equifax and TransUnion, Experian is considered to be one of the three major credit bureaus in the United States. Additionally, it offers a wide range of additional services, including protection against identity theft, credit monitoring, and debt collection, in addition to providing credit reports and scores to both residential and commercial customers.

| Feature | Description |

|---|---|

| Credit reports and scores | Experian provides consumers with free annual credit reports from each of the three major credit bureaus. You can also purchase your credit score from Experian. |

| Identity theft protection | Experian offers a variety of identity theft protection services, such as credit monitoring, fraud alerts, and identity restoration. |

| Credit monitoring | Experian’s credit monitoring service will notify you of any changes to your credit report, such as new accounts, inquiries, or late payments. |

| Debt collection | Experian offers a variety of debt collection services, such as debt counseling, credit counseling, and debt settlement. |

| Other services | Experian also offers a variety of other services, such as auto insurance, renters insurance, and home loans. |

| Visit Website |

What is Experian?

Within the United Kingdom, Experian is the most prominent credit reference agency. In addition to providing individuals with the opportunity to check their credit score, it also gives them access to a more comprehensive credit report that includes information about their personal life, existing financial arrangements, and their financial history. In addition to this, it functions as a “Identity Plus” service, which provides users with protection against identity theft and fraud.

Experian review: Refresh Rate

In addition to providing its members with unrivalled access to their individual Experian credit reports, Experian Credit Tracker also provides them with comprehensive insights into those reports. Customers are given the ability to refresh their Experian credit report on a daily basis through the utilisation of this exclusive service, which offers a distinct benefit to individuals who are especially susceptible to identity theft. When individuals choose to receive daily updates, they are able to promptly detect any changes that have been made to their credit report as soon as they occur.

This provides a proactive defence against any potential fraudulent activities that may occur. It is important to note that the daily revisions take into account more than just the credit report; they also include a daily update to the individual’s FICO score, which is determined by using the most recent information contained within the report. With the combination of this real-time monitoring and FICO score updates, Experian Credit Tracker members are provided with a powerful and dynamic tool that ensures they remain informed and in control of their financial well-being.

Experian review: Automated Monitoring

Not only does Experian provide users with unrestricted access to their Experian credit report and score on a daily basis, but the company also goes above and beyond by implementing automated monitoring and alert systems. These notifications are sent to users via email or the mobile app, and they provide them with timely updates on any significant changes or suspicious activities that have been identified in their credit report.

It is possible that these alterations include the opening of new accounts, the completion of recent inquiries, or the modification of the address that is listed. By taking this preventative approach to monitoring, users are guaranteed to remain well-informed about significant developments in their credit history. This gives them the ability to promptly address any potential issues and ensures that their financial profile remains secure.

Experian review: Education Center

In addition to its core credit monitoring functionality, Experian also provides its members with access to a comprehensive credit education centre. Our review team discovered that this centre contains a wide variety of consumer credit information that is up to date, authoritative, and accurate. Those who are new to credit monitoring as well as those who have tried it before and are looking to gain a better understanding of their credit health and the many factors that influence it will find this to be an excellent resource.

Furthermore, a credit score simulator is incorporated into the subscription package as a standalone feature. Customers are able to see how various financial decisions, such as declaring bankruptcy or paying down credit card balances, taking out a car loan, and other similar choices, could potentially have an effect on their credit score through the use of simulators. As a result of the fact that this simulator is powered by FICO, the predictions are as accurate as one would anticipate from tools of this kind.

Conclusion

According to my own personal experience, Experian has proven to be an extremely helpful tool for monitoring the state of my credit. The platform offers a wealth of information that goes beyond the fundamentals, and it does so by providing regular access to reports and scores. I am able to maintain a proactive approach to managing my financial well-being thanks to the daily refresh feature, which guarantees that I am always up to date on the status of my credit ratings.

The fact that FICO scores are included is one of the aspects that I appreciate because it provides me with a more comprehensive view of my creditworthiness. Because the credit monitoring and reports that Experian provides are available at a price that is reasonable, I consider it to be a worthwhile investment in my financial security. Even though the free version does offer monitoring for changes on the reports of other bureaus, I discovered that upgrading to a monthly subscription provides a more comprehensive solution for monitoring credit.

Experian’s dedication to assisting customers in establishing or reestablishing their credit has set it apart from other companies. In addition to being data, the information that is provided in the reports is a valuable resource that will assist me in making well-informed decisions regarding my financial future. My Experian credit file is protected by an additional layer of control, which is provided to me by the option to lock and unlock it.

This gives me the necessary level of security. The benefits are even more extensive for those individuals who are willing to make an investment in a monthly subscription. Experian goes above and beyond by providing credit monitoring services for all three of the primary credit bureaus. The additional benefits, which include insurance coverage for identity theft up to one million dollars, are evidence of a commitment to providing comprehensive protection measures.

Experian review: The Good and Bad

In addition to providing triple-bureau credit monitoring, the company also provides triple-bureau FICO credit reports at prices that are competitive by the industry. Additionally, you have the ability to place credit report orders with Experian on an as-needed basis.

The Good

- Extensive credit report coverage.

- Constant credit score monitoring.

- Strong identity theft protection.

- Educational tools for financial improvement.

- Dark web surveillance for added security.

The Bad

- Interface could be more user-friendly for beginners.

- Some users report delays in receiving credit alerts.

Questions and Answers

Is the Credit Score Provided by Experian the Most Accurate? Credit scores obtained from the three major bureaus—Experian, Equifax, and TransUnion—are generally regarded as being accurate ratings.

In contrast to FICO, Experian is not typically utilised as a standalone instrument for the purpose of making credit decisions. This is the primary disadvantage of Experian. The results from all three bureaus, not just Experian, are frequently considered by lenders, even those who examine a borrower’s credit report in great detail rather than relying solely on the borrower’s numerical score.